SD51555

5 year old buck +

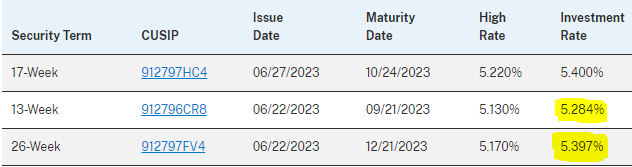

Number of people working falls again. More people taking second jobs.

www.zerohedge.com

www.zerohedge.com

Sent from my iPhone using Tapatalk

Payrolls Soar By 339K, Blowing Away Highest Estimate, Even As People Employed Tumble By 310K Sending Unemployment Rate Higher | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Sent from my iPhone using Tapatalk