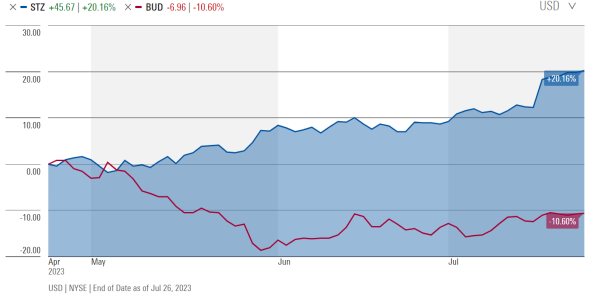

That's the best looking short term treasuries ETF I've ever seen.

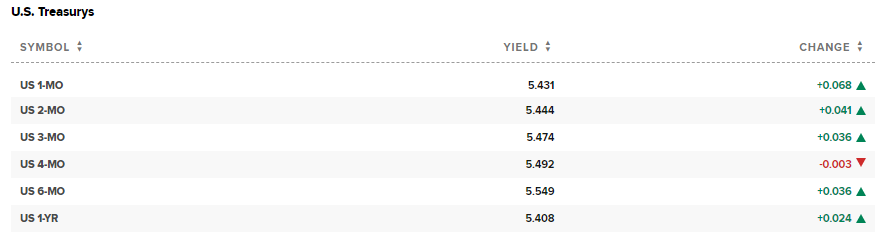

Right now, their distribution equates to a 5.36% yield, and that's after having to give up 0.15% in mgmt fees. It also looks like it's appropriately priced each day that it rises over the month and then the price falls equal to their monthly distribution. That's definitely a simple way to do it. You're likely doing better than me because I'm still sitting on 6-mo bonds that were priced at lower yields cause I bought them a few months ago, and they won't mature for another few months.

There's also about zero risk to those bonds because they keep rolling forward a portfolio of 3-month treasuries. I'm rolling a portfolio of 6-month treasuries. You're going to outperform while bond rates keep rising because your stuff will roll over to the new higher yields faster than mine. When the fed turns and rates start going down, the 6-months are gonna hold longer simply because their duration is longer. The spread between the 3 and 6 is very small.

View attachment 55137

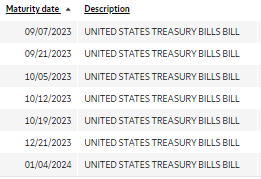

These are the different maturities I'm sitting on right now. Those September treasuries I've got are only turning out 5.15%. That January batch is yielding 5.46%.

View attachment 55138