Foggy47

5 year old buck +

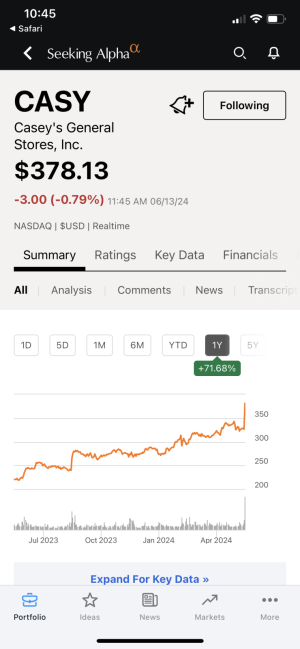

I think that if a stock you like has a good business plan and good products and is well financed (etc etc) then you buy it and it goes down.......time to buy another share or two. Prices seldom move in lock step with our plans. OTOH....if you have owned the stock for a period of a year or two and you have another company that has caught your eye.....sell your loss and invest in something that is moving in the right direction. Easy to say and hard to do.I get it but am I Klink. haha. Do the opposite of what I think is a good idea? Pretty solid logic in my opinion.

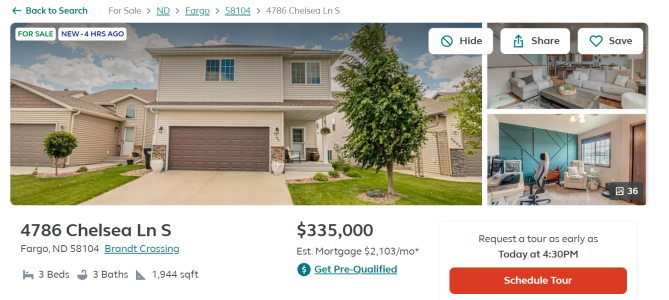

We'll use Valero as an example. I bought it at 168.66, it's now dropped to 148.49. Now I only bought 1 share so I'm only out $20. Like I said I'm not playing with real money until I understand this better. I know now's probably the time I should be buying it but I didn't. Instead of watching that stock go up and down a couple bucks for months on end, would you cut bait and sell it and try to invest in something else you like and try to recoup that money or does it just depend in how you feel about that stock.

I guess what I'm asking is, is it worth waiting around for a stock you believe in to go up or better to pull it and put it in something else you think is going to go up immediately and maybe buy back into valero later on. More on a day trading/quick hitter level. I understand the longer term investments of just putting money in something you have faith in.

I currently own maybe 50 or more individual stocks. All but perhaps 3 or 4 are in the black. Some as much as 20x what I paid for them. We may have sold off 20 losers over the past two years. The key is to own multiple companies.....and for me, stick to an allocation plan. Some will always be winners. Others just are not winners at the moment. Sell those......when you have a better idea.

I don't pick my own stocks anymore.....as I do not want to spend my days researching this stuff and making those decisions. I let the pro's do it....but I am not certain their batting average is better (or worse) than mine. Still....they do have a disciplined approach to doing things. Took me a long time to have confidence in them doing the picking....but I am over that now. lol