SD51555

5 year old buck +

It's not really that much. Total volume for the day is a little over $4 million dollars. A couple thousand penny stock traders pushing around $2,000 each could do that.Anyone know what's going on with GGE? They have really high volume today for some reason but I can't find any information as to why. Earnings maybe?

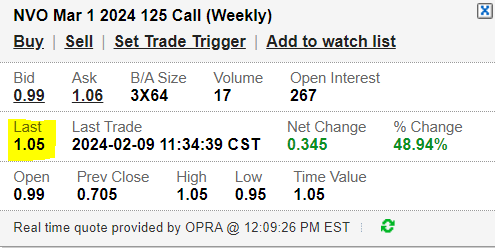

In other news, I added another big chunk to my NVO position today.

EPD is on sale. Do not buy it in a taxable account though. It'll generate a K-1 and that's a PIA if you're a DIY tax filer.

SNAP shit the bed this week. I really like SNAP, and I think they've got a lot of room to run, but their shareholder base is fickle and it's just too easy for a stock like that to go from $11 to $6.

Utility stocks sure aren't pricing like interest rates are going to come down anytime soon. I'd like to stuff some cash in WEC to balance risk, but it doesn't seem like it's got any footing.