-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

Angus 1895

5 year old buck +

U check green giant lately?

GGE?

ohhhhhh

man

GGE?

ohhhhhh

man

SD51555

5 year old buck +

U check green giant lately?

GGE?

ohhhhhh

man

I don’t follow that one, but I do look when someone mentions it. I really don’t do any spec picks, but right now I am starting a position in Rumble RUM. Stew Peters put out a documentary film on Monday, and it’s gotten 7.2 million views. I think that platform is gonna stick. I like it under $10 right now. Would back up the truck under $8.

Sent from my iPhone using Tapatalk

Angus 1895

5 year old buck +

Yes

SD51555

5 year old buck +

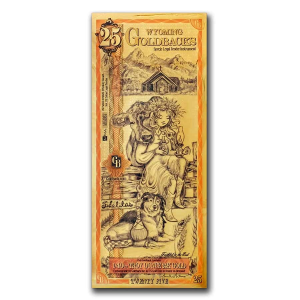

Goldbacks. Anyone ever heard of them? It looks like a functional alternative to crypto, and has actual gold embedded in the physical bills.

I'm kinda digging these things. Want to learn more about them though. This bill sells for $85 fake dollars at Apmex, and has $45-$50 of gold bullion in it. Still a crazy high markup, but the fractionality, physicality, and actual commodity limit of the embedded gold has my interest. I wouldn't mind being paid in goldbacks.

www.goldback.com

www.goldback.com

I'm kinda digging these things. Want to learn more about them though. This bill sells for $85 fake dollars at Apmex, and has $45-$50 of gold bullion in it. Still a crazy high markup, but the fractionality, physicality, and actual commodity limit of the embedded gold has my interest. I wouldn't mind being paid in goldbacks.

Inflation-Resistant Gold-Backed Currency | Goldback

Goldbacks offer an inflation-resistant, gold-backed currency for everyday use. Preserve wealth, hedge against inflation, and support local economies. Learn more!

Last edited:

b116757

5 year old buck +

Why not just buy physical gold if you’re looking for an alternative to crypto? I only buy real estate and index 500 funds. I do have 10-15 oz of silver I bought back when I was in high school but that’s hardly an investment in precious metals. Late 80’s after the last high inflation period silver was very cheap that’s only reason a bought any at all.

Angus 1895

5 year old buck +

RGR issued a $5 special dividend!

must be the Marlins!!!

must be the Marlins!!!

SD51555

5 year old buck +

I'm not looking for an alternative to crypto, I'm looking for an alternative to cash for purposes of functional cash. This is just something that caught my eye today. Regular gold isn't very divisible. This is pie in the sky for now, but it's what money should be. Dictators cannot shut off or counterfeit a commodity currency in hand.Why not just buy physical gold if you’re looking for an alternative to crypto? I only buy real estate and index 500 funds. I do have 10-15 oz of silver I bought back when I was in high school but that’s hardly an investment in precious metals. Late 80’s after the last high inflation period silver was very cheap that’s only reason a bought any at all.

I haven’t opened a 401k statement in 5-6mo… but I bought land. I’ve also pulled my 401 contribution back from max to employer match. After a small cabin is built on the land… I want to look for more using home equity. Not sure how retirement will go (lol) but I haven’t smiled like this in a long time.

b116757

5 year old buck +

I did something similar this year I pulled back on max 401k contributions and bought another 150 acre farm. I was already sort of looking for more farm ground but when this place came up for auction I bought it. Sometimes you have to strike when the iron is hot. I had a pretty good feeling about its hunting potential and its location for commercial businesses down the road if I or one of my boys decided to open up a business. I could see opening a small farm/steel supply in retirement for something to fool with to stay busy and my oldest boy is working on a bachelors degree in diesel technology. I could see him opening a diesel shop on that property at some point in his career. I do look at real estate as an investment not just hunting ground and I expect to have passive income from almost all my real estate holdings.

hunts_with_stick

5 year old buck +

I'm looking for land as well. The biggest thing is being within an hour or so of my residence!

yoderjac

5 year old buck +

I haven’t opened a 401k statement in 5-6mo… but I bought land. I’ve also pulled my 401 contribution back from max to employer match. After a small cabin is built on the land… I want to look for more using home equity. Not sure how retirement will go (lol) but I haven’t smiled like this in a long time.

We bought our pine farm (with others in an LLC) at the top of the market. 15+ years later, it is still only worth 60%-70% of what we paid. I pulled home equity to do it rather than touching retirement funds. I did not spend more than I could afford without adjusting retirement. I have never once had second thoughts about that decision. It has been great for my mental health and provided an escape from the rat-race. Decisions that are not the best for the wallet can often be the best for the soul!

Enjoy your smiling!!!

I'm now creeping up on retirement and am glad I did not cut back on those contributions.

Thanks,

Jack

hunts_with_stick

5 year old buck +

Good info Jack. I agree, I haven't touched my retirement savings or amount % investing...

b116757

5 year old buck +

I’m lucky and have always lived in rural areas. I can’t imagine having to commute like that or longer to my properties. I do own some properties 12 hours away but I have family in the immediate vicinity that manages those properties. I did find a 8600 square foot church for sale at a ridiculously low price that if I hadn’t just bought another farm may very likely have purchased. I tried to get one of my sisters to buy it as an investment but she didn’t inherit the same investment genes I got dealt.I'm looking for land as well. The biggest thing is being within an hour or so of my residence!

Bszweda

5 year old buck +

We bought our pine farm (with others in an LLC) at the top of the market. 15+ years later, it is still only worth 60%-70% of what we paid. I pulled home equity to do it rather than touching retirement funds. I did not spend more than I could afford without adjusting retirement. I have never once had second thoughts about that decision. It has been great for my mental health and provided an escape from the rat-race. Decisions that are not the best for the wallet can often be the best for the soul!

Enjoy your smiling!!!

I'm now creeping up on retirement and am glad I did not cut back on those contributions.

Thanks,

Jack

The joys of buying in 2007/2008. I purchased my first condo in 2008 and also got screwed. Fast forward to today. My house is paid off and I will be paying off my land at the end of March. I've been maxing out my 401k for awhile, and will continue to do so. I will be investing into dividends index funds I never intend to sell. I've had a few land deals fall through in the last two years, and I am at the point of transitioning into enjoying/wanting what I have vs trying to accumulate more.

hunts_with_stick

5 year old buck +

Why did you sell?I sold a cabin and 40 acres early 2008 I could have bought it back a couple years ago for less than I sold it for in 2008 probably should have it bordered national forest.

Similar threads

- Replies

- 18

- Views

- 542

- Replies

- 13

- Views

- 884

- Replies

- 6

- Views

- 430

- Replies

- 8

- Views

- 470