Angus 1895

5 year old buck +

Limit order filled.

New limit order at .55

New limit order at .55

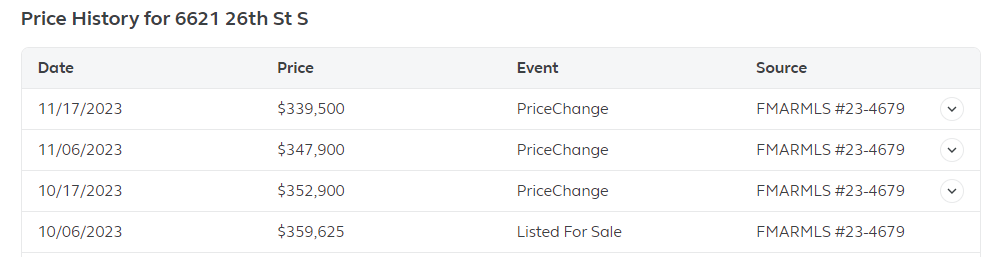

Interesting things are happening in the real estate market. I follow it with quite a bit of interest. I don't recall there ever being so many price cuts on listings, and now what's most interesting, is the speed at which prices are being dropped. If you go on Trulia.com, you can look anywhere and see the pricing history of a listing:

View attachment 60204

Pull up the grid of listings, and look for the down arrow. Inside, you can then see the entire pricing history like I've shown above. Pull up your own area and see for yourself how real time price discovery is going the other direction. I guess the mystery LLC buyers aren't scooping up everything just yet. f

View attachment 60205

AMEN!So long as their is a fed and federal government, there is no market. Only the illusion of a market.

What does garmin do these days?Garmin is up 40% in the last year !

It was funny, I was hunting in the rocky Mountains with a kinda geeky know it all city boy. Telling me the Onyx said this or that.Garmin is up 40% in the last year !View attachment 60794

Very diverse and no debtWhat does garmin do these days?