-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

SD51555

5 year old buck +

Brutal day on Wall Street !

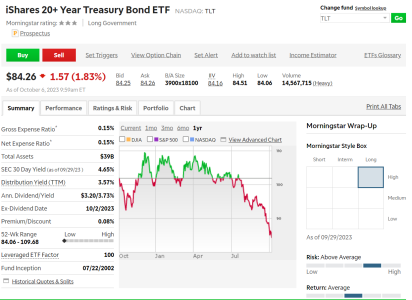

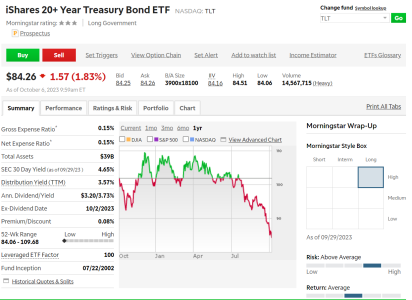

I’m a tad bit concerned. Sometimes I can have the septic touch when it comes to picking entry points. I’m a little worried KMI is gonna shoot straight to $13. Long term bonds are just getting gutted. I wonder how long that’s gonna go on. Somebody has to buy them and finish the ride. Ain’t gonna be me.

Sent from my iPhone using Tapatalk

Bowsnbucks

5 year old buck +

Trends always reverse at some point. Picking the right time to bail out or jump in can be a stressful endeavor. I've been reading articles pointing to bond investors trying to pick that point for longer-term bonds to lock-in higher yields for longer terms. 4.87% locked-in when prices are low might be a big win for income-seeking investors. Seems lots of folks are trying to hit the "peak" of rates to lock-in for 5, 10, or 20 years. Then as rates start to come back down (while folks have rates locked-in), prices / NAV will go back up.

Right now, 5.3% to 5.57% in MM's or short-term paper isn't bad to ride it out. Gravy - no / very little risk.

Right now, 5.3% to 5.57% in MM's or short-term paper isn't bad to ride it out. Gravy - no / very little risk.

SD51555

5 year old buck +

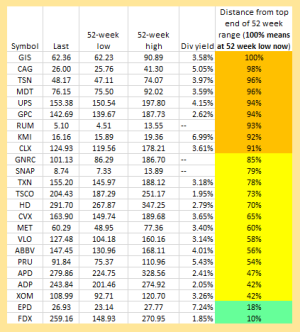

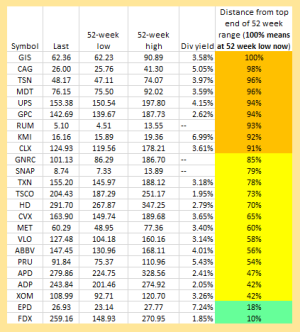

I lost my watchlist a month ago when the TD switch happened. I didn't think to back it up, so I'm slowly rebuilding my watchlist from memory. This is by no means complete, and I keep adding to it. But I saw a tweet come across from the TKL account on twitter tonight. There's a quiet bleed happening in staples and utilities, and I wonder if interest rates on short term bonds aren't finally putting pressure on low risk dividend stock prices. Why take 3.5% and further interest rate risk on a utility when you can get 5.5% on ultra short term bonds and MM? I don't know. Just something I think about. I decided to run my crash list to see how far what I watch has fallen. It's hitting staples hard.

Bowsnbucks

5 year old buck +

A number of the sources I've read lately are asking the very same question. BlackRock, the world's biggest money manager, is telling its clients to go into short-term T-bills, MM funds to ride things out until a clearer change in investor sentiment happens. They and other firms are saying keep an eye on the 10-year yields to possibly lock-in higher rates, and then ride the rise in prices when that happens.Why take 3.5% and further interest rate risk on a utility when you can get 5.5% on ultra short term bonds and MM?

Thoughts anyone??

SD51555

5 year old buck +

I don't see any reason to pick up long term bonds unless they start yielding way way more, and that's only gonna be a deal if the feral (yes feral) government ends their money printing. The future doesn't look great with how much money will need to be printed to keep the grift going. Even 5.5% in MM and 3-mo treasuries is a guaranteed loser, but it's the least worst loser at the moment when you factor in inflation. Long term treasuries are going off a cliff as we speak, and this makes about every bank and insurance company insolvent.

SD51555

5 year old buck +

I don't see how every single bank, insurance company, and pension fund isn't technically insolvent right now. They already have a bailout in place, so this isn't necessarily a problem at the moment, but I have to imagine the market will rear it's ugly head somewhere in all this fake monetary hocus pocus. Maybe once they have to use the bailout plan it could spook the market into consciousness. If you toss in insurance and pension funds, the insolvency has to be into the many trillions.

Foggy47

5 year old buck +

^ If you get to feeling pretty giddy about those long bond interest rates.....here's a little something that should pull you back to reality. And she is in charge????

It's really little wonder why folks are shelling out high dollars for real estate investments. Even if you pay 2x today's value.....it's still going to be there. Cash?....not so much.

It's really little wonder why folks are shelling out high dollars for real estate investments. Even if you pay 2x today's value.....it's still going to be there. Cash?....not so much.

Last edited:

Angus 1895

5 year old buck +

Thermafreeze is lurching higher,higher, higher.

It’s almost worth $0.07……..

It’s almost worth $0.07……..

bwoods11

5 year old buck +

Should I be buying this ? What do they do ?Thermafreeze is lurching higher,higher, higher.

It’s almost worth $0.07……..

Angus 1895

5 year old buck +

They make freezer packs and leg therapy wraps for equines. I got into it during the dry ice Covid craze. It went from $30 to 0.014 cents per share. Now it’s making dramatic gains, so that’s all I know.Should I be buying this ? What do they do ?

Bowsnbucks

5 year old buck +

I recall Buffet saying, "....... be greedy when others are fearful - and fearful when others are greedy......."

It's times like this when Buffet has bought outsize amounts of companies that deliver real cash returns - not speculative price advances. Coke being a prime example, it's a global, powerhouse brand.

Any thoughts on buying at bargain prices?? Wait for further declines??

It's times like this when Buffet has bought outsize amounts of companies that deliver real cash returns - not speculative price advances. Coke being a prime example, it's a global, powerhouse brand.

Any thoughts on buying at bargain prices?? Wait for further declines??

Angus 1895

5 year old buck +

Purchase your positions in incremental fashion. This way you have a chance of finding the bottom.

SD51555

5 year old buck +

There's no stopping it now. I don't know that i've got the courage to ever buy long term bonds the way this is going.^ If you get to feeling pretty giddy about those long bond interest rates.....here's a little something that should pull you back to reality. And she is in charge????

It's really little wonder why folks are shelling out high dollars for real estate investments. Even if you pay 2x today's value.....it's still going to be there. Cash?....not so much.

That would have been a good buy @ .01. It likes .06/.07 too much to buy in now.They make freezer packs and leg therapy wraps for equines. I got into it during the dry ice Covid craze. It went from $30 to 0.014 cents per share. Now it’s making dramatic gains, so that’s all I know.

Bowsnbucks

5 year old buck +

Kinda wonder what tommorow's market's will do. Going to be more than one blood bath. Feels like SHTF days are on the way?

The attack on Israel by Hamas isn't going to help things. I've read several articles recently that pointed out that the "peace dividend" is gone - for now anyway. The relative stability the whole world enjoyed after the cold war ended between major powers is over, and once again Russia has invaded Ukraine in its effort to rebuild the old "soviet union." Now too, China is flexing its muscle over its stated desire to control the entire Pacific region. China also wants to be the dominant global currency - displacing the U.S. dollar. Things like global aggression by major players will not be good for any country's markets - as evidenced by global market volatility.

There are NO simple, easy answers to very complex problems. The world today isn't the world of Roy Rogers riding in to save the day on his horse "Trigger", or John Wayne drawing his pistol and the bad guys lose in short order. I'm sure many of us wish it were that simple. God help us all.

hunts_with_stick

5 year old buck +

Looks like the attack by Hamas is liked by the markets?? Up almost 200?

bwoods11

5 year old buck +

TZPC is the ticker? Interesting if it’s the same company .Thermafreeze is lurching higher,higher, higher.

It’s almost worth $0.07……..

Bowsnbucks

5 year old buck +

Reports are that the sentiment is higher for no more interest rate hikes, so markets are liking that globally.Looks like the attack by Hamas is liked by the markets?? Up almost 200?

Similar threads

- Replies

- 18

- Views

- 544

- Replies

- 13

- Views

- 884

- Replies

- 6

- Views

- 435

- Replies

- 8

- Views

- 470