Tree Spud

5 year old buck +

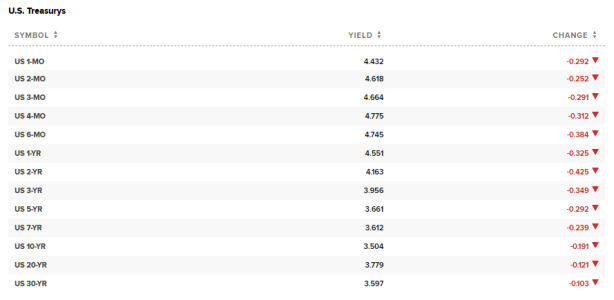

I still don't know why anyone would invest in bonds.

Sometimes you have to know when to walk away from the table and preserve your gains. We didn't see much growth last 2 years, but we also didn't see much in losses either.

When your portfolio is large enough and you are approaching retirement, you start to look at risk differently. Wealth building and wealth preservation needs to shift over time.

If your not going to put some money into bonds, and don't have a strong cash reserve, your choices start to become higher risk with not much of fall back position.