jsasker007

5 year old buck +

OK, Now back to reality.

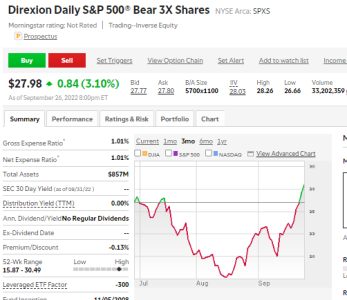

I've been waiting for the SPY to blow like Krakatoa since we swung from maximum stimulative policy to contractionary policy + hyperinflation. I wanted to get set in SPXS to really jack up the return as it went, but just when it looked like all hell was going to finally break loose, it was all suddenly ok the next day.

Nothing ever changes fundamentally, but we swing from "This is the big one!" to the next day the panic is over, despite nothing happening to change the mood. Everyone is a bear right now, but nobody is selling. One of these days we're going to wake up to something really big going under, and that will finally set it off. I just don't know what it will be, or when it'll happen.

It's impossible to say when or if something will cause the big drop. I'm bearish overall, so I'm expecting the short positions to creep up in value over time. I try to short stocks near the peak of one of the rallies, more for my own peace of mind rather than a few extra dollars. We just had a pretty big drop early last week which was good for the index shorts.

I have a couple hundred bucks I use for trying to time the peaks a troughs. It's basically impossible, but it's an interesting exercise. I'm down about 20% on that, but I consider it the cost of the experience/education. It definitely prevents me from trying it with any larger sums.

The real cash is in options, but I'm having a hard time really getting my head around it all. I made 25% in one month on a put on IWM, but I still don't quite understand the nuance of it all. I thought doing it would give me the experience I needed to be more confident with options, but it's still a bit opaque.

Safest thing for me is still just riding the trends, and having a plan. Hopefully I can make decent money on the way down and then buy back in cheap when the dust settles.

I lost some air pressure with META going down. Energy stocks have given back a little too. Won't be too much longer, we can be picking up tech giant stocks for under 10 P/E's. Perhaps the timing of that has something to do with the pope calling all the assets of the church back to the vatican by September 30th.Been a great week for me. My shorts are already up 6%, and everything else is up 2.5% for the week. I guess that will probably come down a bit tomorrow, but then I'll consider buying a put Monday morning if the market rebounds substantially.

I lost some air pressure with META going down. Energy stocks have given back a little too. Won't be too much longer, we can be picking up tech giant stocks for under 10 P/E's. Perhaps the timing of that has something to do with the pope calling all the assets of the church back to the vatican by September 30th.

I figure there's lots of that going on. After the Snowden incident, it didn't seem prudent to keep using the NSA to gather up the data of the globe when they could just have META pull it off everyone's phones with the people's consent.META seems to have been helping the Iranian government crack down on protesters. Expect some volatility the next few days.

I figure there's lots of that going on. After the Snowden incident, it didn't seem prudent to keep using the NSA to gather up the data of the globe when they could just have META pull it off everyone's phones with the people's consent.

I sure got yesterday's lunch pushed in on energy today. What a beat down.

Bond yields are on the move today. Stocks down / bonds up doesn't seem to be a thing all of a sudden.

The 7% 30-year fixed handle is very close for those with good credit.

I took my medicine on META and dumped it for a loss @ $137. @Telemark your positions have to be trending up nicely. Well done fella.

That's the tough part. You can be right, but if you're not right at the right time, those things erode and that money is gone. I was trying to do it in the SPXS and I was too early. Had someone the guts to pick it up below $20 five weeks ago, you'd be in lush clover now. There was no reason for markets to trend up back then, and if you entered at $25 and watched it go to $19 in two weeks, that's an ugly 24% drop. Hard to argue when something like that would turn upward, when there was no reason for it to be going down.GLD and NEM are down, but everything else is soaring. I'm itching to buy some puts, but I'm just not 100% confident enough to make a big play on it. I'm spending all my free time reading about put contracts, and I'm feeling it's worth putting up about $1000 to see what happens on a one month contract.