-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

Woooh whoo! I beat the Dow. Their down 3.94% I'm only down 3.4%

On a positive note I didn't loose a dollar because I didn't sell.

Wait til the 1% interest rate increase next week.

Timing might be about right for a guy five years out from retirement. That’s what I keep telling myself every time we have a ridiculous crash.

Sent from my iPhone using Tapatalk

yoderjac

5 year old buck +

No spin is sufficient for what he and Trump have done, but they sure try hard on both sides!You should do spin for Brandon

Last edited:

Tree Spud

5 year old buck +

Woooh whoo! I beat the Dow. Their down 3.94% I'm only down 3.4%

On a positive note I didn't loose a dollar because I didn't sell.

Wait til the 1% interest rate increase next week.

With 30 year mortgage rates at 6.3%, that 1% prime rate raise next week should really jump start things

SD51555

5 year old buck +

The bigger problem ahead for either us or the fed, is that the fed isn't dumping bonds like they said they would. That's what's really needed to pull back on the money supply. At the rate they're claiming to start unloading bonds, it'll take a hundred years to pull out what the created with a key stroke in the blink of an eye. The challenge is, they're already boxed in with rates being high. Any more sellers in the bond market is only going to push rates up further, and that will blow the asset bubble to bits.With 30 year mortgage rates at 6.3%, that 1% prime rate raise next week should really jump start things

SD51555

5 year old buck +

So far, the plan just seems to be to let inflation run wild. It's really interesting to watch how people are getting by right now.If Annuities and CDs hit 5-6% then we may have serious issues in the stock market.

Tree Spud

5 year old buck +

The bigger problem ahead for either us or the fed, is that the fed isn't dumping bonds like they said they would. That's what's really needed to pull back on the money supply. At the rate they're claiming to start unloading bonds, it'll take a hundred years to pull out what the created with a key stroke in the blink of an eye. The challenge is, they're already boxed in with rates being high. Any more sellers in the bond market is only going to push rates up further, and that will blow the asset bubble to bits.

The Fed is simply running from hole to hole in the dike trying to stop the leaking when the dam is about ready to collapse. Every time the Fed raises rates, the Dems announce more spending.

The Dems are very good at this game and their plan is working. Destroy the financial, security forces, open the border, and all other private institutions so that people have to rely on the Gov't.

Don't expect the Fed to do the right thing ... this is a deliberate plan. Remember the Fed said that inflation was "transitory" ...

SD51555

5 year old buck +

It's best a person don't go back and scrutinize the government reassurances of the past 3 years. A person may lose faith in the experts when they realize that they haven't gotten a single thing right through all this chaos. It's a reasonable shortcut to just assume whatever they are saying, the opposite will happen.The Fed is simply running from hole to hole in the dike trying to stop the leaking when the dam is about ready to collapse. Every time the Fed raises rates, the Dems announce more spending.

The Dems are very good at this game and their plan is working. Destroy the financial, security forces, open the border, and all other private institutions so that people have to rely on the Gov't.

Don't expect the Fed to do the right thing ... this is a deliberate plan. Remember the Fed said that inflation was "transitory" ...

Wait until Uncle sniffy pinchy starts refilling the SPR. We could get energy prices right back up where they want them just after the selection. That's gonna be a blow to supply that will at least put a floor under oil and fuel prices.

SD51555

5 year old buck +

I'm shorting SPY and IWM.

I’ve been trying to catch that wave for a few months and just when it looks like it’s finally gonna blow, it doesn’t, and then we get a 5% move the other way.

Sent from my iPhone using Tapatalk

Telemark

5 year old buck +

I’ve been trying to catch that wave for a few months and just when it looks like it’s finally gonna blow, it doesn’t, and then we get a 5% move the other way.

Sent from my iPhone using Tapatalk

What do you mean?

SD51555

5 year old buck +

I've been waiting for the SPY to blow like Krakatoa since we swung from maximum stimulative policy to contractionary policy + hyperinflation. I wanted to get set in SPXS to really jack up the return as it went, but just when it looked like all hell was going to finally break loose, it was all suddenly ok the next day.What do you mean?

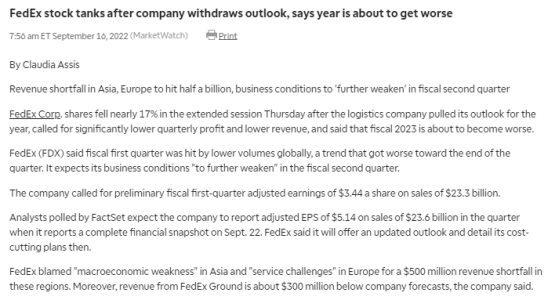

Nothing ever changes fundamentally, but we swing from "This is the big one!" to the next day the panic is over, despite nothing happening to change the mood. Everyone is a bear right now, but nobody is selling. One of these days we're going to wake up to something really big going under, and that will finally set it off. I just don't know what it will be, or when it'll happen.

jsasker007

5 year old buck +

Sentiment is pretty damn low right now. For some reason people don't have faith in our economy---I wonder why? HMMM

chummer

5 year old buck +

Trump ruined it. Sentiment should be high with Brandon in charge now. Hopefully dems can hang on in the midterms then everything will be great. I feel great knowing they are fighting for me.Sentiment is pretty damn low right now. For some reason people don't have faith in our economy---I wonder why? HMMM

jsasker007

5 year old buck +

If Biden can't turn things around I don't think anyone can.

Similar threads

- Replies

- 18

- Views

- 542

- Replies

- 13

- Views

- 884

- Replies

- 6

- Views

- 430

- Replies

- 8

- Views

- 470