Telemark

5 year old buck +

because in retirement (hopefully) you are drawing out more than 90k a year

Have you budgeted for this? In my eyes, you are extremely wealthy. For a retired couple, $90,000 a year is a very lavish lifestyle.

because in retirement (hopefully) you are drawing out more than 90k a year

Take it easy on me boys, as I'm just a millennial, but I've never understood going the ROTH route. To me, when investing in a traditional 401K, I'm essentially getting an interest free loan till I withdraw any money. That's a pile of money after 40 years of interest. Money that the guys that invested in ROTH don't get to accrue.

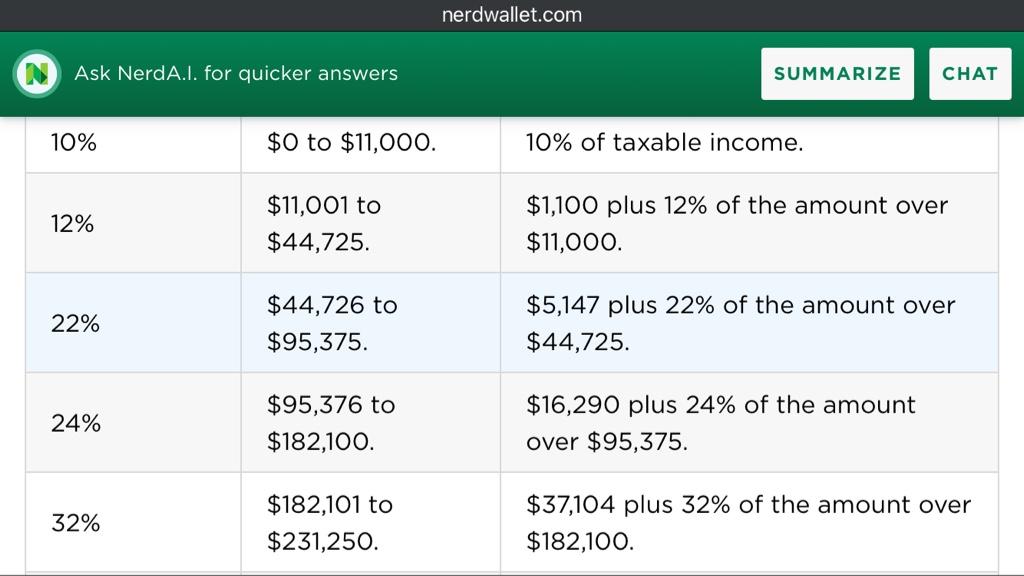

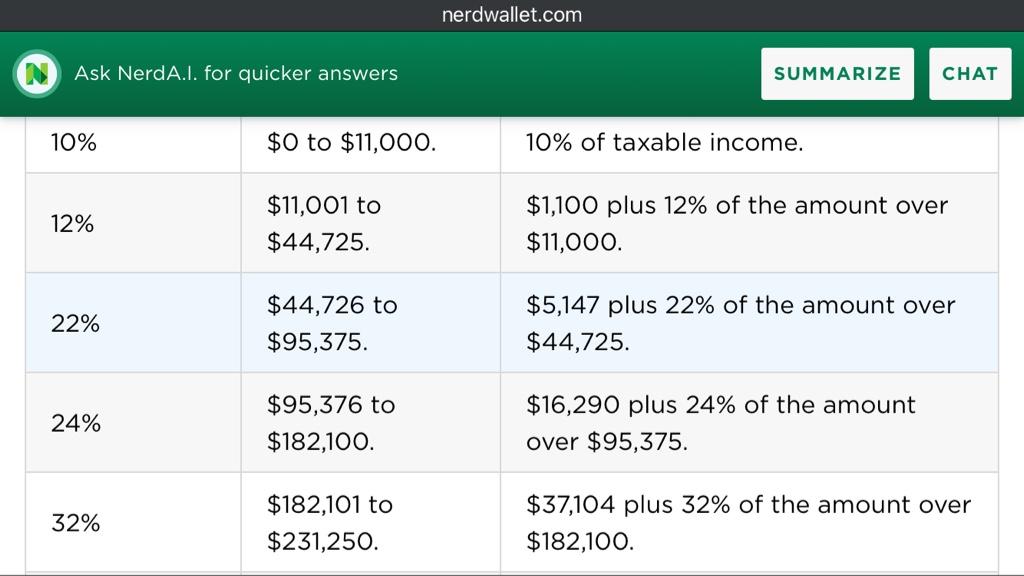

here is 1 example, remember a married couple pays 12% tax on earnings under 90k (89,450 to b exact), and 22% tax on earnings over 90k. (This does not include future limit levels being raised, or taxes going up or down)

if you are under 90k it makes a lot of sense to do Roth, because in retirement (hopefully) you are drawing out more than 90k a year, so you save 10% tax on any money over the 90k.

if you are over the 90k, you can put it in a “traditional” tax free, saving the 22%, then if you withdraw less than 90k a year in retirement, it is only taxed at 12%.

Lol, well, you’re saving 10%. But you are not giving up any accrued interest. You either pay taxes now, or later, but your net reward at the end is basically the same.This is where you guys totally lose me. So you're giving up a lifetime of accrued interest to save 2% on taxes? Surely I must be missing something?

The biggest advantage of a Roth to me....is that I can pass the Roth accumulation on (contributions and increase value via gains and income) to my kids.....without tax. It can continue to accumulate tax-free income though the years......and even be passed to their heirs.....again without taxes on the accumulated value. The gift that keeps on giving. grin.It really doesn't have to be that complicated. The ideal blend is going to look something like this in retirement:

40% tax deferred (traditional 401k, traditional IRA, pension etc)

30% tax free (roth 401k, roth IRA)

30% taxable (plain jane investments)

Ideally, you're able to take your RMD and not get shoved into the higher brackets. You make up the rest of your upper middle class retirement with tax free money while staying in the lower brackets. You have the plain taxable assets in the event you've done well and you don't want to wait for permission from the government to access your own savings at whatever age you want without extreme penalty.

Then it's not such a big deal where you live, what the tax rates are, and what your age is. The error too many make is they take all the tax deferrals while they have kids and less income, and then when all the kids are gone and both spouses are working, they have no room left in their brackets, or tax credits to knock down the bill. One big expense in retirement, and you're shoved into a higher bracket, and you've got to take out $100,000 just to net the $60,000 you need.

Who is paying a 40% effective tax rate?

You can hit that in a blue state.

Sent from my iPhone using Tapatalk

Marginal is the most important rate. It determines that value of deductions and the costs of your next move. When I was converting my last 401k to my roth IRA, I'd do a pretax in early December and use up my entire tax bracket on a conversion in December. Then if I had budget for more, I'd hold the rest over to January and convert it then. It's not a lot, but it's also not hard to avoid.You could hit a 40% marginal rate, but not a 40% effective rate. Even in California, you would probably be under 35% effective rate on 100k.

It really doesn't have to be that complicated. The ideal blend is going to look something like this in retirement:

40% tax deferred (traditional 401k, traditional IRA, pension etc)

30% tax free (roth 401k, roth IRA)

30% taxable (plain jane investments)

Ideally, you're able to take your RMD and not get shoved into the higher brackets. You make up the rest of your upper middle class retirement with tax free money while staying in the lower brackets. You have the plain taxable assets in the event you've done well and you don't want to wait for permission from the government to access your own savings at whatever age you want without extreme penalty.

Then it's not such a big deal where you live, what the tax rates are, and what your age is. The error too many make is they take all the tax deferrals while they have kids and less income, and then when all the kids are gone and both spouses are working, they have no room left in their brackets, or tax credits to knock down the bill. One big expense in retirement, and you're shoved into a higher bracket, and you've got to take out $100,000 just to net the $60,000 you need.

For me, it's all about when you want to pay your taxes, and what are your options when you have a sudden need for cash. I don't want to wait to 59 to retire, and I don't want to have to live in a high cost tax refuge state (FL, AZ, TX). It seems like you can get 160 acres, a house, fish pond, skid steer, tractor, and flail mower in northern MN for what a townhouse costs in Florida or Arizona. I am planning on the 160 acres and a robust travel budget for the worst 90 days of winter each year. If the deer herd gets really bad, I'll have to budget for a 6' low fence around the whole property.Looking at your plan 60% of your portfolio is invested after taxes are taken out. And half of that will be taxed every year, capital gains on divedends etc., or on appreciation when sold. But as you stated Uncle Sam can't tell you when to take it.

| FILING STATUS | 0% RATE | 15% RATE | 20% RATE |

|---|---|---|---|

| Single | Up to $44,625 | $44,626 – $492,300 | Over $492,300 |

| Married filing jointly | Up to $89,250 | $89,251 – $553,850 | Over $553,850 |

| Married filing separately | Up to $44,625 | $44,626 – $276,900 | Over $276,900 |

| Head of household | Up to $59,750 | $59,751 – $523,050 | Over $523,050 |

| FILING STATUS | 0% RATE | 15% RATE | 20% RATE |

|---|---|---|---|

| Single | Up to $47,025 | $47,026 – $518,900 | Over $518,900 |

| Married filing jointly | Up to $94,050 | $94,051 – $583,750 | Over $583,750 |

| Married filing separately | Up to $47,025 | $47,026 – $291,850 | Over $291,850 |

| Head of household | Up to $63,000 | $63,001 – $551,350 | Over $551,350 |

For me, it's all about when you want to pay your taxes, and what are your options when you have a sudden need for cash. I don't want to wait to 59 to retire, and I don't want to have to live in a high cost tax refuge state (FL, AZ, TX). It seems like you can get 160 acres, a house, fish pond, skid steer, tractor, and flail mower in northern MN for what a townhouse costs in Florida or Arizona. I am planning on the 160 acres and a robust travel budget for the worst 90 days of winter each year. If the deer herd gets really bad, I'll have to budget for a 6' low fence around the whole property.

I've got my Roth about funded now to where it doesn't really need anything other than management. Still do Roth 401k and full match at work, max HSA funding every year, and the rest goes into my taxable slice. That's the biggest hole in my pie right now.

Looking at your plan 60% of your portfolio is invested after taxes are taken out. And half of that will be taxed every year, capital gains on divedends etc., or on appreciation when sold. But as you stated Uncle Sam can't tell you when to take it.