You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Roth conversions anyone done this?

- Thread starter b116757

- Start date

FarmerDan

5 year old buck +

I've done the math over and over and over - and decided not to do it. My age and the uncertainties about future returns, in combination, are the factors that made my decision. I opened a Roth nearly 10-years ago. Hindsight is 20/20. If I had the perfect information then I have now I would have been far ahead if I had done it. And, rather than contributing to a traditional IRA I would have, looking in the rearview mirror, contributed a lot more to the Roth. The promise of being in a lower marginal tax bracket in retirement? Hahahah! That doesn't help you much, I know but you need to give it serious consideration.

Telemark

5 year old buck +

I wouldn't do it. I think it's best to have both. Any income I can put into a traditional IRA goes there tax deferred. Anything I have already paid tax on goes in the Roth.

The best thing you can do is don't do anything until you are 100% sure you know what you are doing.

The best thing you can do is don't do anything until you are 100% sure you know what you are doing.

tooln

5 year old buck +

Let me ask this. My wife had a traditional 401, she wanted to get it closer to home and put it into a IRA. The place that had the $$ instead of having it rolled over and sending us the $$ so we could put it into an IRA cashed out the account. They took the tax's out and sent us a check. We tried getting it straight with them but were not successful. Now we are sitting not knowing where to put it so we aren't double taxed on it. We have a call to our tax guy but he's on vacation. Any suggestions?

b116757

5 year old buck +

I’m no accountant and I think that maybe the best place for you to start is contact your tax advisor or whatever financial institution you’re planning to use for the IRA. My only real advise is do not use Edward Jones or any local brick and mortar financial advisor it takes a lot of fee’s from your account to pay for that building and the clowns salaries held within.Let me ask this. My wife had a traditional 401, she wanted to get it closer to home and put it into a IRA. The place that had the $$ instead of having it rolled over and sending us the $$ so we could put it into an IRA cashed out the account. They took the tax's out and sent us a check. We tried getting it straight with them but were not successful. Now we are sitting not knowing where to put it so we aren't double taxed on it. We have a call to our tax guy but he's on vacation. Any suggestions?

FarmerDan

5 year old buck +

Let's remember you are going to pay taxes on your earnings. It's just a question of when.

This is a bad place to be asking for insight because I am one of the respondents!

It's tricky business transferring money out of and in to tax deferred accounts. If you made the request properly then the employer who did the transfer would be at fault...I would think. If you didn't do the request properly I'd guess you are screwed. Tell me you still have the check in hand? To do a proper transfer none of the money can be in your hands. It has got to do direct from one institution to another.Let me ask this. My wife had a traditional 401, she wanted to get it closer to home and put it into a IRA. The place that had the $$ instead of having it rolled over and sending us the $$ so we could put it into an IRA cashed out the account. They took the tax's out and sent us a check. We tried getting it straight with them but were not successful. Now we are sitting not knowing where to put it so we aren't double taxed on it. We have a call to our tax guy but he's on vacation. Any suggestions?

This is a bad place to be asking for insight because I am one of the respondents!

Wind Gypsy

5 year old buck +

interesting consideration, sounds like something that needs to be discussed with an accountant or researched rather than a yes/no answer.

Are the rules for 401k and IRA the same on conversions? They aren't for contributions.. Above a certain income level you don't get to contribute to a traditional IRA "pre-tax" anyway so there is zero benefit to doing it vs a backdoor roth IRA but 401ks can be contributed to pre-tax still with high incomes.

Are the rules for 401k and IRA the same on conversions? They aren't for contributions.. Above a certain income level you don't get to contribute to a traditional IRA "pre-tax" anyway so there is zero benefit to doing it vs a backdoor roth IRA but 401ks can be contributed to pre-tax still with high incomes.

Telemark

5 year old buck +

Let me ask this. My wife had a traditional 401, she wanted to get it closer to home and put it into a IRA. The place that had the $$ instead of having it rolled over and sending us the $$ so we could put it into an IRA cashed out the account. They took the tax's out and sent us a check. We tried getting it straight with them but were not successful. Now we are sitting not knowing where to put it so we aren't double taxed on it. We have a call to our tax guy but he's on vacation. Any suggestions?

Roth. But you can probably only do 60k.

I would definitely try to get it sorted the way you want it first. If you can document that they made a mistake, you might be able to get it fixed, but maybe not. The IRS is pretty strict and doesn't really care who goofed.

Buckly

5 year old buck +

This could happen just by them clicking the wrong box on the computer. Their fault your headache. You definitely need to see a tax advisor on this. In general you would have 60 days to get the money into a new IRA without owing taxes. They should have done a direct rollover and no taxes taken out, however since taxes were taken out and you’re within the 60 days you need to get the money into the IRA. ASAP. BIG NOTE: You will also need to send in the amount of tax they took out. Get tax advice and fix code on the 1099R to State it was a rollover and not a withdrawal so you will be able to get a credit on your tax return. I think that’s the only way to fix it back after they already sent the tax in. You’ll need to get the tax paid back next year in a creditLet me ask this. My wife had a traditional 401, she wanted to get it closer to home and put it into a IRA. The place that had the $$ instead of having it rolled over and sending us the $$ so we could put it into an IRA cashed out the account. They took the tax's out and sent us a check. We tried getting it straight with them but were not successful. Now we are sitting not knowing where to put it so we aren't double taxed on it. We have a call to our tax guy but he's on vacation. Any suggestions?

, so use a good tax guy. Anyway, you shouldn’t have to pay anymore tax on it even if you just decide to put it in the bank.

Last edited:

Buckly

5 year old buck +

In my opinion you seem to have a good setup. If you’ve now got everything going to a Roth. I understand concern about the RMDs but no one says you have to take it and spend it. You can reinvest right back into a Roth or whatever you want.I have about half my 401K in Roth now. I swapped to Roth on my contributions several years ago. In my chosen career path our 401k’s are generally not needed income in retirement so we are worried about RMD’s later in retirement.

Angus 1895

5 year old buck +

Switch to Roth if you can afford the taxes.

If your money is now in equities…..the value is most likely compressed, but you may have to sell, wait , rebuy……that could monkey with the value.

keep it tax deferred if you believe that your tax burden will go down…………….over time.

Really? Taxes go down?

If your money is now in equities…..the value is most likely compressed, but you may have to sell, wait , rebuy……that could monkey with the value.

keep it tax deferred if you believe that your tax burden will go down…………….over time.

Really? Taxes go down?

bigboreblr

5 year old buck +

Not very intellegent, but anytime money exchange hands, someone is sneaking out a few dollars. "Take out the cokd hard cash' movie quote.

The rollercoaster ride of the 401k sucks right now. Selling low isnt a good idea.

When do you plan to retire? If its going to be soon, then maybe. Gonna be working a decade or more. Keep it where it is.

The rollercoaster ride of the 401k sucks right now. Selling low isnt a good idea.

When do you plan to retire? If its going to be soon, then maybe. Gonna be working a decade or more. Keep it where it is.

Telemark

5 year old buck +

I’ve found it a myth that you’ll be paying less in taxes or your tax rate will go down after you retire. Lol.

It's not a myth. It just varies by individual, and it can even vary by year for the same individual. That's why both options are available.

Jerry-B-WI

5 year old buck +

I wish all my retirement funds were in Roth accounts. The company I worked for didn't offer a Roth option until about 6 months before I retired. I think if you have enough tax write offs, kids, mortgage interest etc. I'd go with all Roth and skip the traditional 401, IRA. You're going to get a bunch of your taxes back anyway. Unless your employer would offer a match on both types of accounts. At least get the match.

Trumps tax break will expire in 2025 and may have a big impact on your tax situation and how much is left to invest for retirement.

And remember when you die your beneficiaries have ten years to get their inheritance out of the account. Traditional 401k and Ira will be taxe as regular income and could bump them into higher tax brackets. Thanks Mom and Dad. Your heirs will pay no taxes on the Roth accounts they inherit.

Wether you fellas like it or not insurance through the ACA is based on your taxable income, may not remain that way in the future though, and if you can play it right the cost is zero. Not a bad deal, it's saving me about 20k a year.

Trumps tax break will expire in 2025 and may have a big impact on your tax situation and how much is left to invest for retirement.

And remember when you die your beneficiaries have ten years to get their inheritance out of the account. Traditional 401k and Ira will be taxe as regular income and could bump them into higher tax brackets. Thanks Mom and Dad. Your heirs will pay no taxes on the Roth accounts they inherit.

Wether you fellas like it or not insurance through the ACA is based on your taxable income, may not remain that way in the future though, and if you can play it right the cost is zero. Not a bad deal, it's saving me about 20k a year.

tooln

5 year old buck +

Talked to my tax man. He said no problem a this happens a lot. He said open a traditional ira as a rollover. Then add the amount that was taken as tax . At year end when filing taxes the amount taken as tax will be refunded.Let me ask this. My wife had a traditional 401, she wanted to get it closer to home and put it into a IRA. The place that had the $$ instead of having it rolled over and sending us the $$ so we could put it into an IRA cashed out the account. They took the tax's out and sent us a check. We tried getting it straight with them but were not successful. Now we are sitting not knowing where to put it so we aren't double taxed on it. We have a call to our tax guy but he's on vacation. Any suggestions?

g squared 23

5 year old buck +

Conversions are a tough call, your heirs will definitely appreciate the Roth dollars someday.

As far as Roth contributions, I can’t imagine tax rates decreasing when I retire, and I don’t want to have a substantially lower income, so I’m taking the hit now and maxing out the Roth 401k. Employer match goes into the pre-tax bucket, and I have an additional brokerage account to fill the 3rd bucket.

Sent from my iPhone using Tapatalk

As far as Roth contributions, I can’t imagine tax rates decreasing when I retire, and I don’t want to have a substantially lower income, so I’m taking the hit now and maxing out the Roth 401k. Employer match goes into the pre-tax bucket, and I have an additional brokerage account to fill the 3rd bucket.

Sent from my iPhone using Tapatalk

SD51555

5 year old buck +

The considerations to do this are not as daunting as you'd think. Ask yourself these questions:

*Will your tax rates be higher, lower, or the same in retirement?

*What percentage of your wealth is tax free (roth) now?

*Can you afford to pay the tax out of pocket now?

Let's assume there is no roth savings at all, and your tax rates will be the same, excluding any predictions on future tax rate changes. I would still open a roth and get it connected to the same outfit that has your traditional IRA. The reason for that is, if there is another stock market crash that lingers for a few days, you'll want to already know what you can afford to eat in taxes, and shove as much money 'under the fence' as you can while prices are down, and you'll want all of that set up and ready so if the opportunity presents itself, you can make a call and push it while the window of opportunity is open.

Second, you need to have some tax free savings in retirement for emergencies and unexpected major expenditures. If you need $40,000 to side your house, and $25,000 to do the roof, and you didn't win the hail storm lottery, you don't want to get shoved into a higher tax rate just to keep your stead from falling apart.

Third, if the tax rates are going to be a wash, pay the taxes when you are able to pay the taxes.

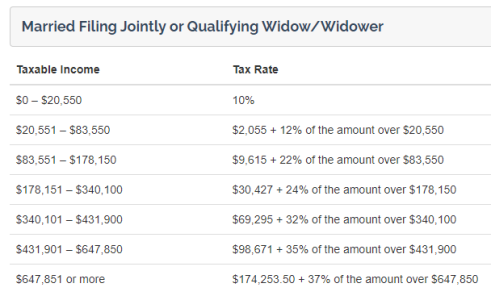

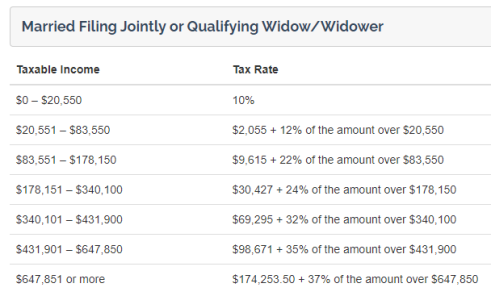

Fourth, know your tax brackets and use them up. For example, if you have a taxable income of $140,000 and perhaps your next bracket jump hits at $178,000 ---> then convert $38,000 in December and use up the rest of that lower rate, assuming you can afford the tax hit on what you can convert.

*Will your tax rates be higher, lower, or the same in retirement?

*What percentage of your wealth is tax free (roth) now?

*Can you afford to pay the tax out of pocket now?

Let's assume there is no roth savings at all, and your tax rates will be the same, excluding any predictions on future tax rate changes. I would still open a roth and get it connected to the same outfit that has your traditional IRA. The reason for that is, if there is another stock market crash that lingers for a few days, you'll want to already know what you can afford to eat in taxes, and shove as much money 'under the fence' as you can while prices are down, and you'll want all of that set up and ready so if the opportunity presents itself, you can make a call and push it while the window of opportunity is open.

Second, you need to have some tax free savings in retirement for emergencies and unexpected major expenditures. If you need $40,000 to side your house, and $25,000 to do the roof, and you didn't win the hail storm lottery, you don't want to get shoved into a higher tax rate just to keep your stead from falling apart.

Third, if the tax rates are going to be a wash, pay the taxes when you are able to pay the taxes.

Fourth, know your tax brackets and use them up. For example, if you have a taxable income of $140,000 and perhaps your next bracket jump hits at $178,000 ---> then convert $38,000 in December and use up the rest of that lower rate, assuming you can afford the tax hit on what you can convert.

SD51555

5 year old buck +

If a person totally gets this wrong, there doesn't seem to be as much financial incentive to move to a lower tax state when you put in the difference in housing costs. Your place in a blue state may be worth $450,000. To get that same square footage in Texas, Florida, or Arizona, you're probably going to have to pay an extra $500,000-$700,000 to get a house of similar size to avoid paying $10,000-$20,000 in state income taxes each year.

Similar threads

- Replies

- 14

- Views

- 1K