Take it easy on me boys, as I'm just a millennial, but I've never understood going the ROTH route. To me, when investing in a traditional 401K, I'm essentially getting an interest free loan till I withdraw any money. That's a pile of money after 40 years of interest. Money that the guys that invested in ROTH don't get to accrue.

It’s more like “deferred interest”.

for the record, I do my 6000-6500 a year in Roth/401k, then about 12-14k a year in annuity/401k/traditional. The numbers fluctuate depending on how much overtime I work in a year.

here is 1 example, remember a married couple pays 12% tax on earnings under 90k (89,450 to b exact), and 22% tax on earnings over 90k. (This does not include future limit levels being raised, or taxes going up or down)

if you are under 90k it makes a lot of sense to do Roth, because in retirement (hopefully) you are drawing out more than 90k a year, so you save 10% tax on any money over the 90k.

if you are over the 90k, you can put it in a “traditional” tax free, saving the 22%, then if you withdraw less than 90k a year in retirement, it is only taxed at 12%.

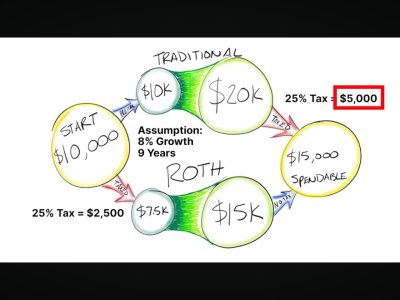

the above illustration just demonstrates that, if taxes, brackets, and investment time all stay the same, it doesn’t make you more or less money either way in the end.

another example would be: you set yourself up to draw out 90k a year to stay in that 12% bracket. But one day you decide to buy a truck/boat/land/vacation, etc. you can pull from your Roth fund, tax free, to pay for those things.

just one reason to diversify