I am confused about the confusion and will either clarify or add to it. It's a difficult subject to address in the brief time available. Let's start by understanding there are two different land records systems in play. I only have some understanding about how the two play together - or not - here in Virginia. I would add that I do a lot of things, but playing inside the lines is one of my many vocations. An individual county here is the holder of both sets of records. The land deed containing the property description and a legal survey of the described property, if there is one, are recorded in the land records system. That's one function in a county. The other is the collection of real estate taxes and, until recently and only in part, are the two synchronized - maybe.

You need to understand some history to understand where we are and why there are discrepancies. First, they have been two separate departments each with their very own missions.

Prior to about 2010 ownership and acreages for tax purposes were held as data in a table. And separately and apart there were CAD created paper tax maps. I liken those maps to a schematic. Given the available technology they were adequate for seeing who owned what in an area. The tax maps may have been based on some loose interpretation of deeds or may have been accepted as offered. These tax maps span a hundred years give or take. The only concern of the county real estate assessors office was to fund county operations. If you were taxed on 125 acres- yes, acres ae important for this purpose - you could dispute the acreage if you believed it different. If you thought you had only 110 acres and could verify this then the acreage in the tax table was changed and maybe the paper tax maps was changed -but I doubt it. It was expensive to create a new set of tax maps.

Along comes new GIS technology and the counties - and here in Virginia the state says hey wait a minute. We need to digitize those crudely drawn tax maps and join the tax table to it. The process was a nightmare. One county i am intimately familiar with found they had 11,000 parcels in the tax table and when the paper maps were converted there were 17,000 parcels. Reconciliation went on for years. Today there are 3 counties in Virginia that refuse state funding to digitize the old paper maps and cleanup and match the tax table data to the GIS create tax parcels. They know their tax records are faux pas.

Today, the integration of deeds, surveys, and tax parcel is better going forward, but most counties have no interest in going backwards. And what about deeds and their descriptions? I'm not a surveyor but I know several. I question them about this. Most don't understand GIS and projection systems and how their survey results are translated into a GIS system. Todays experts can account for all of that. As I understand it, surveys are done by assuming a flat plane. On the Earth elevation changes when taken into account will produce a slightly different acreage, but its inconsequential for small areas...but it's a factor. When you look at aerial imagery on something like Google Earth the imagery has been corrected from a flat surface to one that accounts for elevation changes. Now, I'm a little fuzzy on this, but in some cases - with some surveys done years ago the survey plat is created using only the deed information for the property being surveyed. There's no attempt to edge match the determined property boundary with the adjacent property boundary. Today it might be, but I'm not sure.

One example and I'll stop adding to the confusion. Recently the National Park Service (National Battlefield Park Division) was gifted a farm property next to a friend's farm. The friend swears the survey commissioned by NPS takes some of his land. His farm was surveyed by his grandfather back in the 1940's. I went to the county courthouse and for the princely sum of $2 I got a copy of both deeds and surveys. The old survey was simply a written description. No map. It was done in metes and bounds, distances measured in chains and links. The NPS survey was quadrant bearing, distances in feet, Virginia State Plane South. I don't think the metes and bounds survey gave the coordinate system used.

I rolled up my sleeves and used GIS processes to put both surveys on a GIS map. I'm no expert at such things but I pretty damned good at it. Guess what? The edges of the two adjoining properties don't match. There's an overlap of between 20 and 50 feet that amounts to about 20 acres, maybe? I readily admit some of that might be because of my inexperience with such things, but my experience tells me it is possible.

Now - ONX. They simply hijack the county tax parcel information readily available in the public domain. They take that free information, put it in an app and sell it to you. If you have a beef with their "ownership" information you probably have or had a beef with the county where the land is located. A county might update their records but ONX probably won't update yours without paying a new fee.

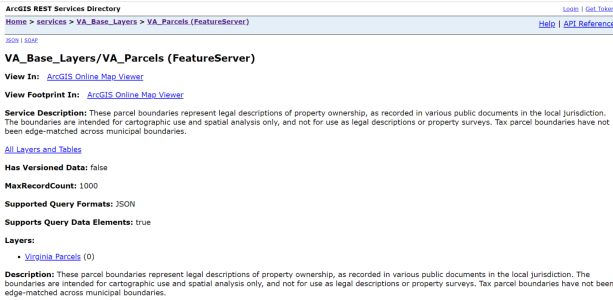

Just to prove a point (I don't remember which one!) copy this link and drop it into Google Earth. Bam! You have all the digitized tax parcels in Virginia...

https://gismaps.vdem.virginia.gov/arcgis/rest/services/VA_Base_Layers/VA_Parcels/FeatureServer

View attachment 45115