hunts_with_stick

5 year old buck +

Agreed, would be nice to know, to I start buying or wait some more?Is this just the beginning?

Agreed, would be nice to know, to I start buying or wait some more?Is this just the beginning?

100%. Just like with Covid. For some reason gravel magically jumped from about $400/load to $700/load because of….?Another problem I can see coming is the excuse for everyone to raise prices and gouge the customer even if they are not affected by tariffs. I think that's going to have a worse effect on what we all pay than the actual tariff costs. jmho

Saw this today on Twitter...lol

View attachment 74710

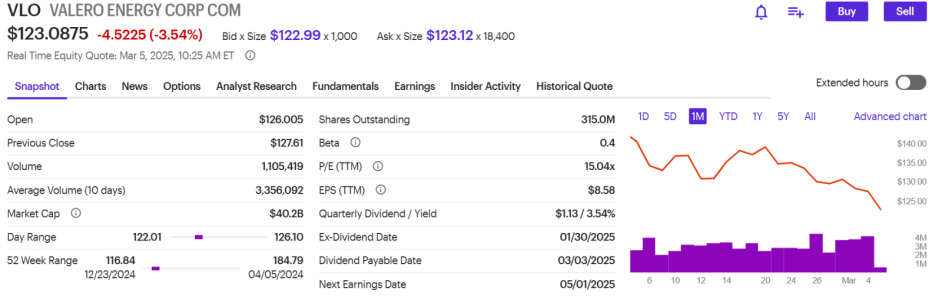

Foreign language to me.VLO is headed for a bottom again. Great time to tee off the peaks (this one a lower peak).

View attachment 74743

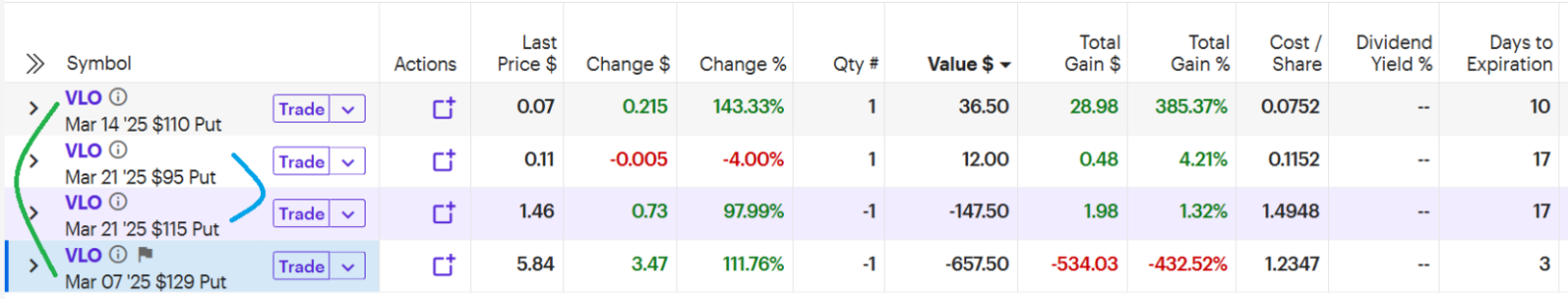

I don't wanna buy it outright because I think it could keep going down. So, I sell a put far below where it is now. I've already got one for $129 out there, and good chance I'll get those shares and start in the hole. That's ok. I also bought a $110 put as insurance (floor) for those shares.

So, I'm acquiring at $129, insured the floor at $110. I got paid $1.23, insured it for 7.5 cents.

Just sold a second put to acquire at $115, insured the floor at $95. I got paid $1.49, insured it for 11.5 cents.

View attachment 74744

I bought FI,NICE,BWXT. 1 share of each just so I can check it everyday for a while and decide if I want to get in for the long haul or not. I'm having a tough time finding stocks that I feel are a safe and solid investment right now with all the uncertainty lately. Don't want to get into anything at the wrong entry price.

VLO is headed for a bottom again. Great time to tee off the peaks (this one a lower peak).

View attachment 74743

I don't wanna buy it outright because I think it could keep going down. So, I sell a put far below where it is now. I've already got one for $129 out there, and good chance I'll get those shares and start in the hole. That's ok. I also bought a $110 put as insurance (floor) for those shares.

So, I'm acquiring at $129, insured the floor at $110. I got paid $1.23, insured it for 7.5 cents.

Just sold a second put to acquire at $115, insured the floor at $95. I got paid $1.49, insured it for 11.5 cents.

View attachment 74744

I’m increasing my position in Gilead today.

Even though it’s P/E is crazy high Fidelity lists it as very undervalued?

Can we invest in Russia? They seem to be having a good week or two. Big winners today