SD51555

5 year old buck +

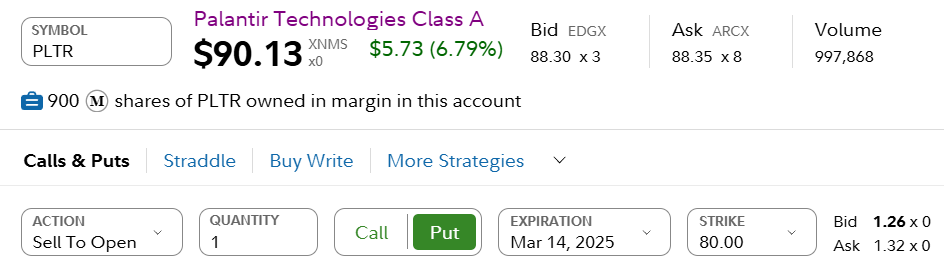

Are you selling puts that are covered by cash? Do you just end up buying the shares if the price goes below the strike, and the contract holder executes? And then you have the shares?

Yes, yes, and yes. I only buy directly if I think it’s a smoking deal. Otherwise I’m perfectly content making the option income and not actually holding the stock.

In this case, I think getting VLO under $120 is not a bad deal at all.

Sent from my iPhone using Tapatalk