Westwind

5 year old buck +

I’m probably too conservative with investing.Thats kinda what I have been doing- Have a little side account I have been buying some individual stocks here and there but would like to up my game a little

I’m probably too conservative with investing.Thats kinda what I have been doing- Have a little side account I have been buying some individual stocks here and there but would like to up my game a little

Way more than is needed is a safe bet.Que the price increases. Major artery on the east coast trucking route closed indefinitely, plus the largest port on the East coast shut down because the bridge is in the water. Wonder how much we print to fix this?

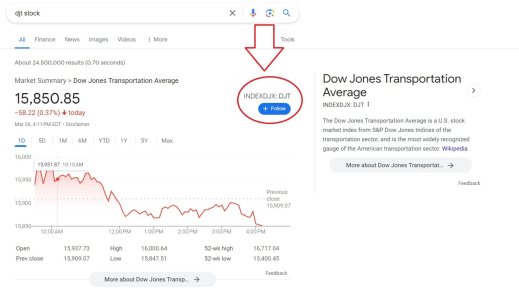

I've been holding 1 for months just to keep an eye on it. Today I think I could have broke even if I would have sold it.Trump stock went bananas today ! Did anyone have any shares ?View attachment 63397

Trump stock went bananas today ! Did anyone have any shares ?View attachment 63397

Had a similar experience myself. Schwab, said I was up over $18,000 on my one share. Of course I checked how much I could sell it for and it showed about 70 bucks. I kept it. I think I bought it for $67.I have/had just under 300 shares. I bought my first shares on day 1 just below $14. Had various buys along the way. I sold a little over 1/3 of them today for $71.xx average. My schwab account say I am still up 102% on my remaining 170 shares at the close.

This morning when it spiked I was trying to sell at $75+. My ****ing POS Schwab account was not recognizing the stock and letting me trade it. I spent 47 mins on the phone with them. At one point my account said I had $3.2 million and my position was up astronomical. My account thought DJT was dow jones transportation average. I told the lady at schwab to close my account and send me a check for $3 million. The best she could do for me was to put in a "dispute" cause I was trying to sell 100 shares at $78. I expect them to tell me to pound sand. Feeling pretty screwed. Most of my sales came in my roth where the broker and I set a pre market target. Hit that in the first 20 seconds. In the afternoon I let a few more shares go around 72-73. I'm still pissed.

View attachment 63398

My understanding is.....that Schwab's Bank and their stock / bond / money market / etc (Schwab Brokerage) are treated as different entities. Had this discussion a time or two....and have felt comfortable with such. Prove me wrong?I had about 4 hours in the car over the weekend, and I got to listen to the Rogan podcast with Bret Weinstein, #2101. His talks are always good because he comes at the issues of the day with a very dry and practical sense to himself.

At the 10:50 mark or so in the beginning of the podcast, they get to talking about "The Great Taking" and what's coming for the unprepared, and frankly, has largely been happening all along and is picking up speed. He made two quick points about the dollar:

*It's still a means of exchange that enables people to assign an agreed value to goods and services. That still works.

*What's no longer working, is the dollar is no longer a way to store wealth. When inflation was tame to almost flat, there was no risk to holding cash. Now, if you hold cash, you're losing wealth at an alarming clip in terms of what it can buy in food, energy, transportation, housing, healthcare, services, and durable goods today, vs months into the future.

I keep thinking about that and where a person can hide out. What's more disturbing is what can/may/will happen to assets held with trustees when the trustees start going bust. I'm kinda worried about Schwab, because I've got assets at Schwab. When the banks start looking like they're gonna finally bust, Schwab is in the top 10 that slide the most.

Anyway, my next project is to research 'The Great Taking' more and find out what the hell is going on with that.

I have no idea what will happen in the markets short term. Investing and investors have changed from a market that would move based on merit and positive earnings to what seems like more of a popularity/media advertising pushing things up without the financials in place to justify any movement up or down. I still think going with companies that are still competitive and have been around a long time makes sense. To me the markets seem broken and don't make much sense lately(last few years). Buy low and sell high. Fed seems clueless and lost as to how to do their job. jmhoWhat is everyone else thinking for potential rate cuts in 2024? Part of me says election year suggest FED will cut a few times even in the face of persistent lingering inflation. Other part of me says they CANT cut because inflation seems much stickier than they'd like to admit....

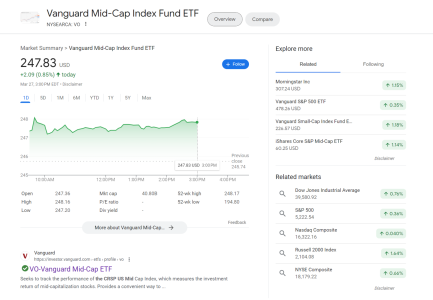

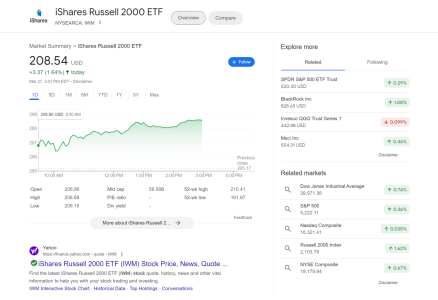

If they actually start cutting rates I'd expect small and mid cap stocks to start running hard. I decided with my financial advisor to place bets on rate cuts and we invested 2 years worth of Roth contributions for my wife and I into the Russell 2k and into a mid cap ETF last month. We are up about 2% on each. I'm eventually expecting sector rotation into these small and mid caps promptly followed by a sharp downturn in the market. I have some small crappy stocks been moving up and the Russell 2k is starting to creep up as well. I also expect the whales to make all of their moves before the FED makes their move. We could see some really big moves on stocks that are really beaten down.

Not financial advice. Just trying to thinking like Nancy Pelosi. I'm gonna start to feel really good if the Russell 2k can crack 212-213 area.

View attachment 63421

View attachment 63422