-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

If course… about an hour after I dip my toe in the water. Smdh

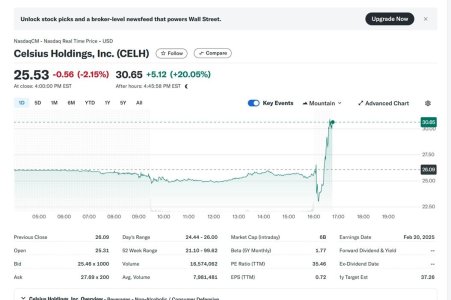

I like to watch this livestream when I am home for the close. They were talking about CELH being down on earnings along with a bunch of other stocks.... I think you are correct and the earnings were not out yet. The stock was down on acquisition news.

I think the earnings are now out....

The stock is now pumping. Been 11% down and now up 12%......

ETA: complaining too soon. Wow!

Angus 1895

5 year old buck +

Just sold some for $34.40

Thanks

Buddy!

Thanks

Buddy!

bwoods11

5 year old buck +

My buddy worked his whole life for XCel Energy. I don’t disagree with you .Look at Excel energy ,, you can not go wrong with elec. utilities ,, not flashy but everyone turns on the lights daily ,,, been very , very good to me over 25 years ,, buy and hold, no ongoing sales commission, no fees ,, just slow growth

I remember they had some issues many years ago and it was under $10/share…

Telemark

5 year old buck +

Do some of you trade stocks on the daily?

I trade intraday. Because of the time zone difference, I started with the premarket at 7, and I try to be done by 11. Fidelity's platform is not great for premarket trading. I will probably have to pay for a service soon, but if it pays for itself it's worth it.

SD51555

5 year old buck +

I try to roll all my options every week. Sometimes it takes 10-15 trading days, sometimes less than 5. Once the gain exceeds the linear rate of time erosion, I’ll buy them back and rewrite them.

When those high flying stocks are soaring and crashing, those are the times to be selling options. On PLTR, even after rebounding $10 from its low of $95, you could still sell a March 7th $95 or $100 call and get paid pretty well. But make damn sure you’re prepared to eat 100 shares at those prices, because if the crowd moves on to the next shiny stock, that could be $50 before you even have the shares and you’re way in the hole.

Sent from my iPhone using Tapatalk

When those high flying stocks are soaring and crashing, those are the times to be selling options. On PLTR, even after rebounding $10 from its low of $95, you could still sell a March 7th $95 or $100 call and get paid pretty well. But make damn sure you’re prepared to eat 100 shares at those prices, because if the crowd moves on to the next shiny stock, that could be $50 before you even have the shares and you’re way in the hole.

Sent from my iPhone using Tapatalk

Telemark

5 year old buck +

I have changed my mind on PLTR. There was a lot more negative news overnight, so I will be watching the premarket when it opens at 4, and I will probably be looking to sell half my position. I'm worried there will be more panicked selling today, and I would rather take a small gain and hold a smaller position than have a bunch of cash tied up, waiting for the price to come back up.

Telemark

5 year old buck +

I try to roll all my options every week. Sometimes it takes 10-15 trading days, sometimes less than 5. Once the gain exceeds the linear rate of time erosion, I’ll buy them back and rewrite them.

When those high flying stocks are soaring and crashing, those are the times to be selling options. On PLTR, even after rebounding $10 from its low of $95, you could still sell a March 7th $95 or $100 call and get paid pretty well. But make damn sure you’re prepared to eat 100 shares at those prices, because if the crowd moves on to the next shiny stock, that could be $50 before you even have the shares and you’re way in the hole.

Sent from my iPhone using Tapatalk

Man, I cannot get my head around your put strategy. I started scalping instead, and it's going pretty well. Your covered call strategy is still solid, and I really appreciate the insight. I'm up 6.5 % for the year, which is setting this year up to be a strong personal best. I'm getting much more consistent in my winners, and I'm cutting my losses a lot sooner than before.

Telemark

5 year old buck +

SD51555

5 year old buck +

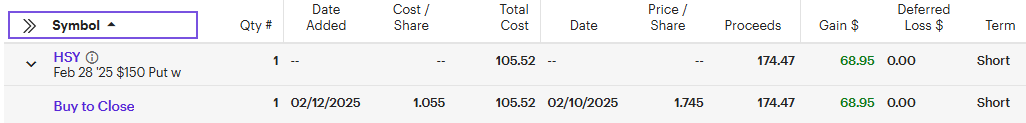

It's all about teeing off the peaks and valleys. If you believe the peaks and valleys are highs and lows, it can be a great place to sell an option in case it gets even better. Here's one that went right. I mentioned I took a poke at Hershey a few weeks back. Here's how it turned out.Man, I cannot get my head around your put strategy. I started scalping instead, and it's going pretty well. Your covered call strategy is still solid, and I really appreciate the insight. I'm up 6.5 % for the year, which is setting this year up to be a strong personal best. I'm getting much more consistent in my winners, and I'm cutting my losses a lot sooner than before.

Here's how I picked the time to do it. First, HSY is a dividend aristrocrat, which is most important. Two, it's got decent enough option income. Three, it was flirting with lows not seen in a long time. Once it's near where I wouldn't mind buying it, one person may just buy it, I'd rather throw out a put and acquire it that way, and if I don't get it, which in this case I did not, I'll take the money and run. I sold the $150 put, and would have been happy owning it at $150. 48 hours I was in and out of that and back on VLO puts.

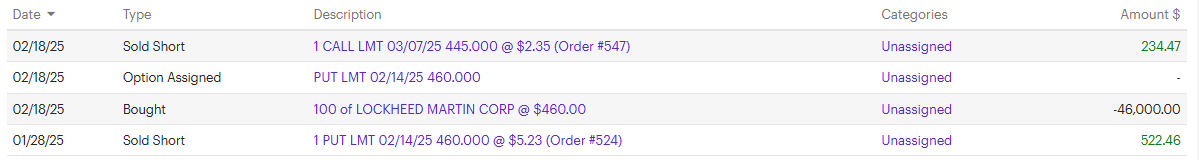

Now, here's an example of when this goes badly. The only things assured in government spending is war and theft, so when war theft went on sale, I was all in. Here's how it turned out. I thought i saw a good time to try a put-acquisition strategy on LMT on 1/28, so I sold one. After the big drop on 1/28 and I picked my spot, It just kept falling, and then I owned it $25/share in the hole right outta the chute. So, here I sit, selling calls every week or two trying to claw my way back out of it. So far, between the put income and the first call income, I've clawed back almost a third of that unrealized loss so far. Now I just need those calls to not hit, because i don't want to get topped out and lose my shares at a loss.

Angus 1895

5 year old buck +

If it gets above $150 I sell some.

If it gets below $120 I buy some.

Speculating the Qubt is going higher higher higher soon.

If it gets below $120 I buy some.

Speculating the Qubt is going higher higher higher soon.

Mortenson

5 year old buck +

Wanted to thank everyone for the outpouring of financial tips for my kid. I had him read thru the last several pages of this thread. One thing I'm probably cautious about is getting too much money in his name before possible college application time. I told him yesterday I bought a bunch of Celh for my ira. He spent some time learning about the company and answering a few questions for me, so that he'd learn about PE ratios and such. He wanted to invest in it also, but we didn't get it done on time for his account. I did match what he put in, as I will for other 3 when it's their turn. Now if you guys would do me a favor and post when you're selling your celh, thx.

I dusted off my old book, the Millionaire Next Door, and had him read the chapter called Frugal Frugal Frugal. I would've guessed that book came out 15 years ago. Was a little sad to see it came out in 96. I lost out on the powerful years of compounding interest, but they're a good age now to get started.

I dusted off my old book, the Millionaire Next Door, and had him read the chapter called Frugal Frugal Frugal. I would've guessed that book came out 15 years ago. Was a little sad to see it came out in 96. I lost out on the powerful years of compounding interest, but they're a good age now to get started.

Howboutthemdawgs

5 year old buck +

Awesome!!! Great job pops.

I sold celh this am but call options. Made a nice 48 pop. Honestly not sure how far this one has to run. I feel like all these energy/hot food products of the day only have so much juice till the next one comes along

I sold celh this am but call options. Made a nice 48 pop. Honestly not sure how far this one has to run. I feel like all these energy/hot food products of the day only have so much juice till the next one comes along

jsasker007

5 year old buck +

I honestly think CELH can go to $70. It's just getting back on track. jmo

Great call 007CELH is another one that's going to double or triple soon.

jsasker007

5 year old buck +

SMCI is the one I have the most optimism for in the very near future.

Mortenson

5 year old buck +

That's good enough for me. I sold it. Got 30% in one day. Will look to get back in depending. I need to hit singles.Awesome!!! Great job pops.

I sold celh this am but call options. Made a nice 48 pop. Honestly not sure how far this one has to run. I feel like all these energy/hot food products of the day only have so much juice till the next one comes along

Similar threads

- Replies

- 18

- Views

- 559

- Replies

- 13

- Views

- 894