Bowsnbucks

5 year old buck +

I didn't say 4% was great interest at all. With the amount of money Buffet has in hand, I'm sure he can negotiate a higher interest rate than any of us can. But if he doesn't see a smart place to invest due to high valuations across the markets, it's hard to beat cash at that level.

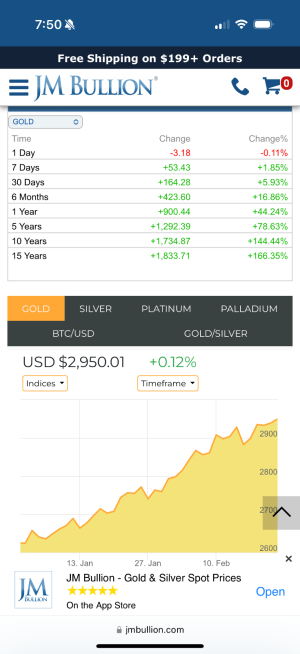

Over a long period of years, gold hasn't been close to stocks for growing wealth. Gold has its short-term "days in the sun" once in a while, but most CFP's don't advise putting much money in gold. Gold's long-term track record is way too sketchy. So say the CFP's.

Over a long period of years, gold hasn't been close to stocks for growing wealth. Gold has its short-term "days in the sun" once in a while, but most CFP's don't advise putting much money in gold. Gold's long-term track record is way too sketchy. So say the CFP's.