SD51555

5 year old buck +

I scooped up a lot of Valero on this dip.I still think Nvidia will go up from here, although it could be choppy !!

Applied Digital is one I’m adding shares, & I think Valero Energy is a decent buy as well.

A lot.

I scooped up a lot of Valero on this dip.I still think Nvidia will go up from here, although it could be choppy !!

Applied Digital is one I’m adding shares, & I think Valero Energy is a decent buy as well.

Never made money in them. Somehow, no matter what the price of their commodity, they don't go under when they're down, and they always lose money when they're high. I just hate mining stocks.Do any of you look at mining companies? I am looking at some US based that have dividends.

Was looking at NEM, SSR, those types, just something maybe out the box? Iono....

I scooped up a lot of Valero on this dip.

A lot.

Mags just filled at 55. I'd love for it to keep dropping. Would love to see a 10% correction here in January. I have a SEP, 2 Roth IRAs and a 529 to put money into.

I'm bullish on lots of stuff in the Mag 7. Tesla FSD and Tesla energy, all things Microsoft, Google and Amazon will keep grinding higher, NVDA is a monster, and Apple is Apple, Meta is reasonably priced for the amount of money they are generating.

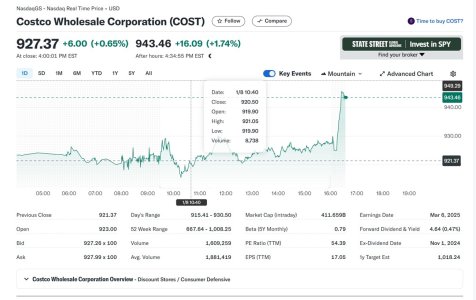

I think I'll buy a couple shares of Costco over the next few days. I'd like to get it for under 900.

AMZN looks like it might dip below 220 soon.

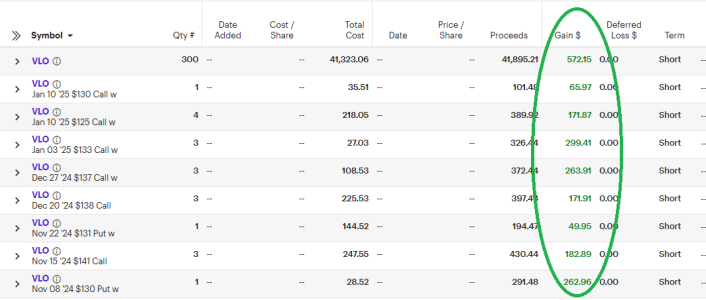

They're a solid monopoly company. Their earnings will ebb and flow with politics and war, but they have a lock on their market. High prices will return and it'll be good. Even if they do not, Valero is a cash juggernaut when you sell call options on it. If it's flat, I'm making north of 25% income on it. Appreciation is just icing on the cake.What do you like about Valero? It's been dropping for a year.

I think they have over 20 refineries? Very diversified, key locations . I’d have to look back but the earnings are solid . Dividend, around 4%What do you like about Valero? It's been dropping for a year.

At least I can't lose any money today.

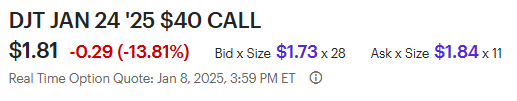

Dive in and try it. You can't hurt anything selling calls. The worst outcome when selling calls is you sell at a given price, and the stock flies past your sell price. DJT would be a good one to practice on. I'm not saying DJT is a good stock, but it's a cheap stock and can get you in the game. You could buy 100 shares for $3500, sell the January 24th $40 call for $1.80. The other thing that could happen is the bottom falls out, but you don't have to sell calls to eat the loss of a stock price implosion.Interesting. I haven't ventured into selling options yet. My account will let me sell options covered by shares or cash.

Dive in and try it. You can't hurt anything selling calls. The worst outcome when selling calls is you sell at a given price, and the stock flies past your sell price. DJT would be a good one to practice on. I'm not saying DJT is a good stock, but it's a cheap stock and can get you in the game. You could buy 100 shares for $3500, sell the January 24th $40 call for $1.80. The other thing that could happen is the bottom falls out, but you don't have to sell calls to eat the loss of a stock price implosion.

My feelings are, if I'm going to own it, I might as well get paid while I wait to see what happens.

View attachment 72878

$1.80/$35.00 = 5.1% x 26 two week periods in a year = 134% cash generation rate per year.