-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

Foggy47

5 year old buck +

Since when do you get "giddy" over an extra 1/2 point yield? The markets are just closer to the norm's of past years. Yawn.

SD51555

5 year old buck +

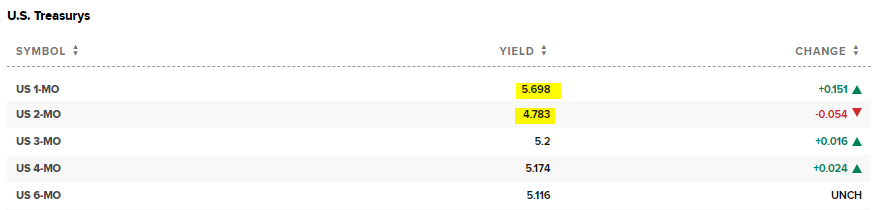

It's not the yield. The spread between the 1 and 2 month has completely gone in opposite directions this week. I have no idea what that means, but it's interesting.Since when do you get "giddy" over an extra 1/2 point yield? The markets are just closer to the norm's of past years. Yawn.

Bowsnbucks

5 year old buck +

You may be an exception to the majority. I've seen and heard employers crying "poor house" for years - ones that had several VERY expensive homes scattered around the country in HIGH DOLLAR areas. Their office staffs were driving Mercedes, and one even bragged about losing several hands of poker for $15,000 each - laughing off the losses as most of us would a $1 loss. Those are the people I'm talking about. Ones that have their own helicopters, yachts, private jets, lavishly-stocked underground bunkers, etc. - but just can't pay their employees fairly, or force them to pay for their own medical coverage. If I was worth that kind of money - making $5 million or more per year - I wouldn't have the heart to screw my employees that way.Hard work won’t get anyone there.

One day I came home with a stack of bank paperwork I needed my wife to sign. As basic as I can make it, those papers said if my endeavor went bust she lost her home, her car, her jewelry and everything of value in our life and we were broke and homeless.

I was about 33 years old with a 3 year old at home. We carried several million in revolving credit debt for years. I got lucky, it worked. It could have went the other way. I was and still am surprised at the people who I gave employment that thought I was the greedy business guy. There were people on the payroll for many years that brought more home then I did after all the bills were paid.

It takes balls not hard work. And there is no way I would do it again..

I'll say that not all employers are ultra-greedy. It's sad that many are. The Turkish man that started Chobani yogurt (found in many grocery stores) made each of his employees millionaires a couple years ago - in thanks for all they had done to help him build the company from scratch. The business community / Chamber of Commerce HATED him for being generous to his employees. Their anger toward the Chobani founder was the subject of news articles around the country, and in news broadcasts on TV. But his employees would do anything for him, because he recognized their efforts in a meaningful way that bettered their lives.

Stick with me here. A couple decades ago, the founder of the company that makes "Polar Fleece" material / fabric did a generous thing for his employees. The factory (in a New England state - not sure which one) had a big fire, destroying much of the plant. The founder / owner kept their pay checks and medical coverage going to them despite being burned-out at the factory. The employees told the owner they wanted to help him re-build, since he was kind enough to keep paying them. They all worked countless hours cleaning out the plant, salvaging whatever they could of equipment, and pitching in on the re-building process. The workers made food and brought in to keep everyone fed while they re-built their factory. Work continued around the clock until the factory was up & running again. The founder / owner was in tears, as were the employees when it was back to normal again. Those employees had NO OBLIGATION to put their own sweat & blood into re-building the business - but because the owner kept their paychecks coming and their medical coverage paid - they WANTED to help the owner & business get back running again. The employees couldn't say enough good things about the owner. That story made The Reader's Digest back then, not long after it happened.

Compare those 2 guys with Bezos, Musk, the CEO's of Fortune 500 companies, and other owners worth multiple millions. I fully realize that smaller companies that don't have those kinds of revenue streams can't afford to pay 6 figures to all their employees. But bonuses & periodic raises as the cost of living rises go a long way for employee morale & dedication. (See above 2 examples). It boils down to the "Golden Rule" more or less.

Congrats on your success, Bill.

jsasker007

5 year old buck +

Seems that any company mentioning AI now gets an instant rise in value from investors. Just a big game is really all the markets are. Bad news will drive prices down instantly if the news is true or not. Banks are at the mercy of the people keeping their money in the banks. Panic the people about the banking world and boom, you get everyone pulling their money out and banks are in trouble. I see it as a good time to buy bank stocks at a great price. Not all banks are equal and that's where the research pays off most of the time in determining which banks are the best BET. I say bet because nothing is guaranteed in the stock market.

Telemark

5 year old buck +

Seems that any company mentioning AI now gets an instant rise in value from investors. Just a big game is really all the markets are. Bad news will drive prices down instantly if the news is true or not. Banks are at the mercy of the people keeping their money in the banks. Panic the people about the banking world and boom, you get everyone pulling their money out and banks are in trouble. I see it as a good time to buy bank stocks at a great price. Not all banks are equal and that's where the research pays off most of the time in determining which banks are the best BET. I say bet because nothing is guaranteed in the stock market.

Be careful with banks that have a lot of deposits from tech startups. There's a reason the banks that are failing are in San Francisco.

jsasker007

5 year old buck +

Is there anything that isn't failing in Fairysisco? Point taken though and due diligence is a must to know who's a good or bad risk.

Bill

Administrator

You may be an exception to the majority. I've seen and heard employers crying "poor house" for years - ones that had several VERY expensive homes scattered around the country in HIGH DOLLAR areas. Their office staffs were driving Mercedes, and one even bragged about losing several hands of poker for $15,000 each - laughing off the losses as most of us would a $1 loss. Those are the people I'm talking about. Ones that have their own helicopters, yachts, private jets, lavishly-stocked underground bunkers, etc. - but just can't pay their employees fairly, or force them to pay for their own medical coverage. If I was worth that kind of money - making $5 million or more per year - I wouldn't have the heart to screw my employees that way.

I'll say that not all employers are ultra-greedy. It's sad that many are. The Turkish man that started Chobani yogurt (found in many grocery stores) made each of his employees millionaires a couple years ago - in thanks for all they had done to help him build the company from scratch. The business community / Chamber of Commerce HATED him for being generous to his employees. Their anger toward the Chobani founder was the subject of news articles around the country, and in news broadcasts on TV. But his employees would do anything for him, because he recognized their efforts in a meaningful way that bettered their lives.

Stick with me here. A couple decades ago, the founder of the company that makes "Polar Fleece" material / fabric did a generous thing for his employees. The factory (in a New England state - not sure which one) had a big fire, destroying much of the plant. The founder / owner kept their pay checks and medical coverage going to them despite being burned-out at the factory. The employees told the owner they wanted to help him re-build, since he was kind enough to keep paying them. They all worked countless hours cleaning out the plant, salvaging whatever they could of equipment, and pitching in on the re-building process. The workers made food and brought in to keep everyone fed while they re-built their factory. Work continued around the clock until the factory was up & running again. The founder / owner was in tears, as were the employees when it was back to normal again. Those employees had NO OBLIGATION to put their own sweat & blood into re-building the business - but because the owner kept their paychecks coming and their medical coverage paid - they WANTED to help the owner & business get back running again. The employees couldn't say enough good things about the owner. That story made The Reader's Digest back then, not long after it happened.

Compare those 2 guys with Bezos, Musk, the CEO's of Fortune 500 companies, and other owners worth multiple millions. I fully realize that smaller companies that don't have those kinds of revenue streams can't afford to pay 6 figures to all their employees. But bonuses & periodic raises as the cost of living rises go a long way for employee morale & dedication. (See above 2 examples). It boils down to the "Golden Rule" more or less.

Congrats on your success, Bill.

You’re never going to get it. This is America, you can work where you want, may have to move but you can. Or you can hire who you want for a wage “they” accept. I never once held a gun to someone and forced them to take a job I had.

I don’t have a helicopter, plane, bunker etc. but I’m happy for the guy or gal that does, good for them. Gives the rest of us something to look up to, Not scorn. Last I checked Musk was giving the entire country of Ukraine free internet. What a prick!

jsasker007

5 year old buck +

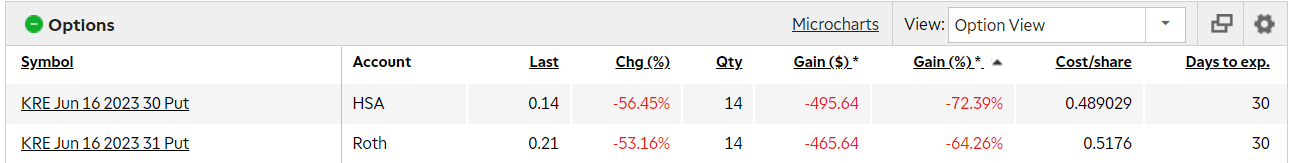

Don't think I'll ever be brave enough to go the option route. I like to rely on my own stupidity---I lose plenty that way.

SD51555

5 year old buck +

I normally never buy options unless something like this comes around. I do 99% of my options stuff on the sell side, writing calls or puts to sell to the speculators. It's good and juicy income. It is very very difficult to make money buying options, but if a person is right, the upside can be enormous. I don't operate there. I'm content with 1-3%/mo in income selling covered calls and puts.Don't think I'll ever be brave enough to go the option route. I like to rely on my own stupidity---I lose plenty that way.

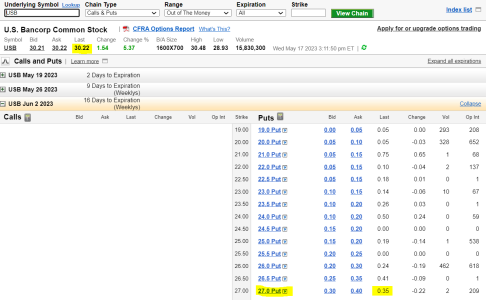

One that has my eye right now is USB. It's up today, which isn't good. But if it reaches back down to that upper $27-$28 range, the $25 2-week put could be juicy. If you did it today at $27, you'd get over 1% for 13 trading days. I'd be ok with owning some at $25 if it actually hit. I hope it doesn't, and I'd like to keep whacking this for 1.3% every two weeks until they go ex-dividend at the end of June.

Last edited:

Telemark

5 year old buck +

I normally never buy options unless something like this comes around. I do 99% of my options stuff on the sell side, writing calls or puts to sell to the speculators. It's good and juicy income. It is very very difficult to make money buying options, but if a person is right, the upside can be enormous. I don't operate there. I'm content with 1-3%/mo in income selling covered calls and puts.

One that has my eye right now is USB. It's up today, which isn't good. But if it reaches back down to that upper $27-$28 range, the $25 2-week put could be juicy. If you did it today at $27, you'd get over 1% for 13 trading days. I'd be ok with owning some at $25 if it actually hit. I hope it doesn't, and I'd like to keep whacking this for 1.3% every two weeks until they go ex-dividend at the end of June.

View attachment 52844

Did you buy puts on BUD?

SD51555

5 year old buck +

No, didn't touch that one.Did you buy puts on BUD?

Troubles Trees

5 year old buck +

I don't fit in anywhere on this thread, I do follow it though, hoping someone that is good at this stuff would "tell" me what to buy and when to sell :) but from an outside perspective it would seem now would be a good time to buy Budwiser stock?No, didn't touch that one.

bwoods11

5 year old buck +

No I think it will touch low to mid $50sI don't fit in anywhere on this thread, I do follow it though, hoping someone that is good at this stuff would "tell" me what to buy and when to sell :) but from an outside perspective it would seem now would be a good time to buy Budwiser stock?

BUD has not been a good investment overall, beer is being eaten up by Craft Breweries. Lots of competition.

Coors has been a better stock I believe ? But the 10 year return is not anything fantastic.

Troubles Trees

5 year old buck +

This is exactly why I don't dabble in this stuff lolNo I think it will touch low to mid $50s

BUD has not been a good investment overall, beer is being eaten up by Craft Breweries. Lots of competition.

Coors has been a better stock I believe ? But the 10 year return is not anything fantastic.

Always wanted to, just have no clue what I am doing. Thank you for the reply Bwoods!

SD51555

5 year old buck +

There are too many variables out there that cannot be forecasted or charted. One would have to know what the war department, central banks, and big spending fasciae governments were going to do. None of those are market forces. We call it a market, but it’s not.

If and when the fed pivot happens, I expect we’re gonna see rockets higher like we’ve never imagined possible. But it won’t be because anything changed other than the final chapter of dollar stability.

Sent from my iPhone using Tapatalk

If and when the fed pivot happens, I expect we’re gonna see rockets higher like we’ve never imagined possible. But it won’t be because anything changed other than the final chapter of dollar stability.

Sent from my iPhone using Tapatalk

Similar threads

- Replies

- 18

- Views

- 542

- Replies

- 13

- Views

- 884

- Replies

- 6

- Views

- 430

- Replies

- 8

- Views

- 470