This is very interesting. I'm definitely not a tax expert, but I'd think there may be an issue if you make a small profit on 3/5 years and then on year 6 buy a $75k skid steer or tractor. But maybe not, I really have no idea how that works. I know that I'd like to get a new tractor and if I can take that cost away from my non-farm income somehow that would be good! I've just always assumed that is not possible, but perhaps it is and I need to look into this further.

I'm also not a tax expert, and I would greatly appreciate anyone pointing any errors they think I'm making.

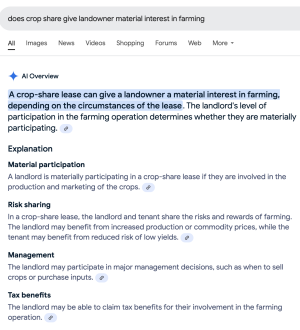

From a "

how the world ought to work" perspective I understand your point. I don't disagree.

However, the 3 of 5 year profit appears to be a trigger that causes the IRS to take a look. That doesn't necessarily mean they'll contact you, but it does trigger something on their end.

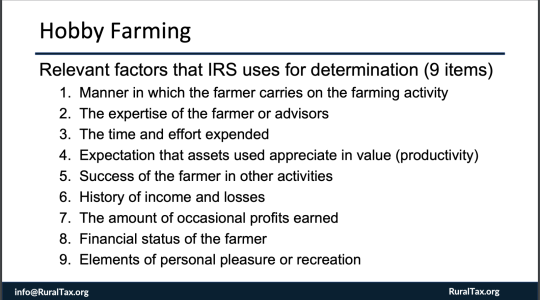

Here is a great slide deck overview, straight from the government overlords.

I'd encourage anyone considering their tax deductions on their hunting land to read that carefully.

Here's an example of the type of info it has:

When I started researching this a few years ago I very quickly reached the conclusion that I do not want to be declared a "hobby farm".

So far, I'm only deducting the stuff that would be wierd not to (taxes, insurance, crop fertilizer), the dozer rental for repairing the ag field, and my tractor purchase.

I could also deduct fuel, driving to the property, herbicide (that I spray in places other than the ag field), tree planting expenses, grass seed for erosion control, etc. But that stuff doesn't add up to much, other than driving (2h round trip almost every weekend), which feels silly to deduct.

I am choosing to play it safe to avoid tripping the hobby farm evaluation due to lack of profit. I'm not suggesting its unethical or inappropriate to deduct more. I'm just trying to protect my opportunity for large deductions, based on the information I have found.