-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Farm land value over time

- Thread starter Native Hunter

- Start date

It gets a step-up on basis upon inheritance, so successors pay no capital gains tax until they sell. And then it’s only the gains between the time they inherited and they sell.It sounds with a 1031 you can avoid paying taxes if you hold on till it and when you pass on you will it to someone? The person receiving the property wouldn't immediately have to pay the capital gain taxes?

b116757

5 year old buck +

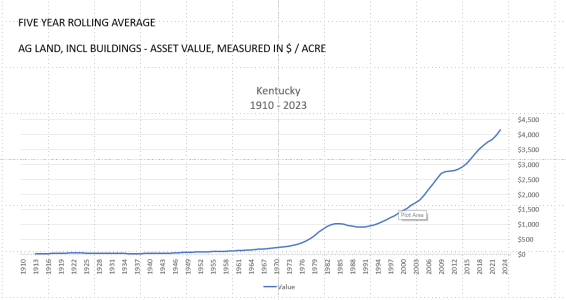

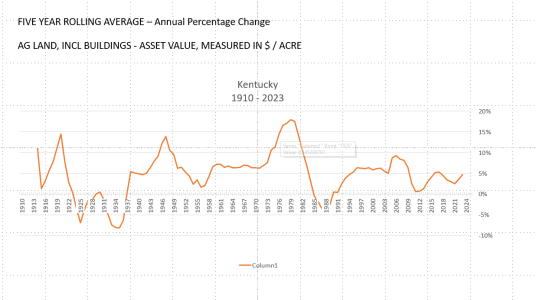

Farm land values very nearly doubled twice from 1969 to 1982 during our last decade of high inflation they did stagnate for a time after 1982 and were pretty stable pre 1969. If our economy falls into a decade of turmoil as it did during the 1970’s perhaps farm ground isn’t to bad of place to be invested. In our current cycle I’d say we are much closer to 1969 than we are from 1982 but who can say for sure.

blueKYstream

5 year old buck +

As mentioned, the estate pays tax on the step-up in value at the estate's choice of 1) time of death or 2) 6-months following. When the inheritor sells the land, they pay capital gains on the difference (sales price minus the land value following the step-up valuation) unless there's a 1031 "like-kind exchange". I believe the purchase has to occur within about 45 days or so from the sale though under a like-kind exchange. The best option would be finding the estate tax return. Otherwise, perhaps the county has that information as I would assume the tax assessor probably increased the land valuation at that time. It's probably going to be a decent capital gains tax depending on the size of the land.

Last edited:

S.T.Fanatic

5 year old buck +

Farm land values very nearly doubled twice from 1969 to 1982 during our last decade of high inflation they did stagnate for a time after 1982 and were pretty stable pre 1969. If our economy falls into a decade of turmoil as it did during the 1970’s perhaps farm ground isn’t to bad of place to be invested. In our current cycle I’d say we are much closer to 1969 than we are from 1982 but who can say for sure.

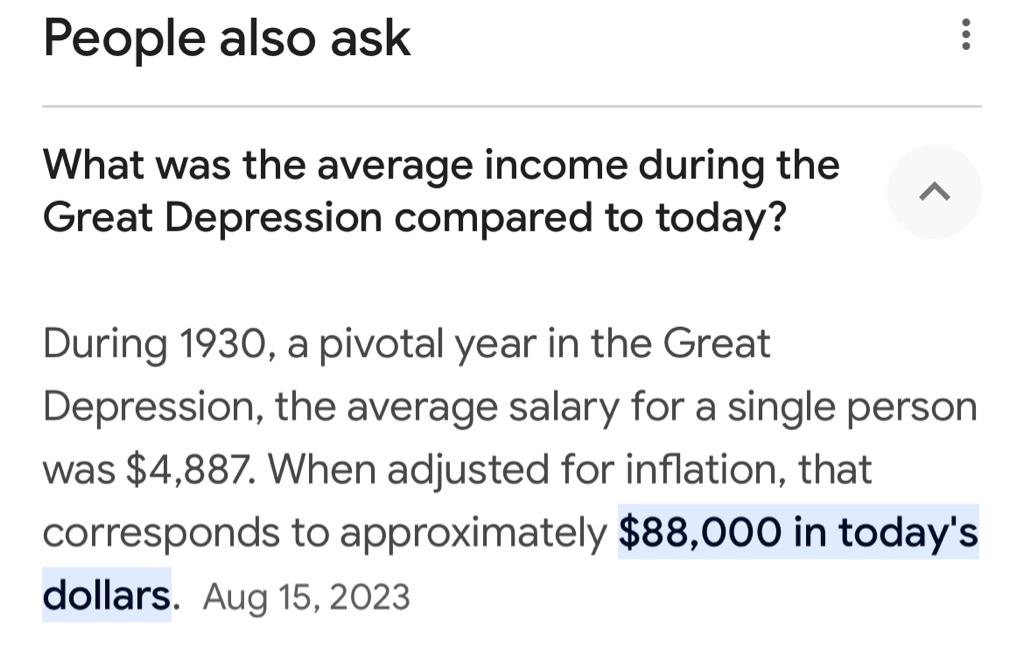

Turmoil? We are much worse off then led to believe.

Sent from my iPhone using Tapatalk

I’ve seen this. I feel like I need a little more data.

Turmoil? We are much worse off then led to believe.

Sent from my iPhone using Tapatalk

FarmerDan

5 year old buck +

Update: I just spoke with a friend of mine who is a retired county agent. He put me on to this USDA document that gives farmland values for every county in the United States from 1850 to 1982. Enjoy..............

https://www.card.iastate.edu/farmla...n-the-united-states-by-counties-1850-1982.pdf

Certain topics fascinate me. This is one of them. I think the document linked by Native is a recompilation of Ag Census results. Census are conducted every 5 years. It's good stuff. But there's always a but!

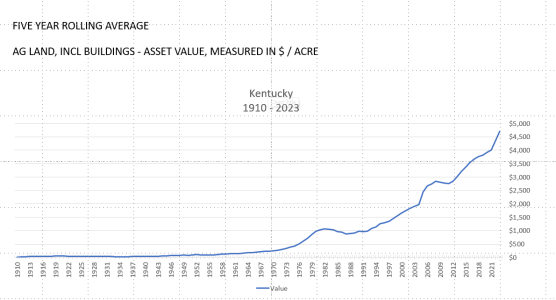

NASS (USDA's National Agricultural Statistics Service has a lot of online data. A more complete Farmland Value / Acre. None of this is sales data. It's an economist's estimate of AVERAGE value annually. These numbers could have been 2x the average ... or something less. It's farmland total. Every farm has different class of land. Cropland can be 20% or more higher than the average. Pasture and forest maybe 20% less. Then there are the building values. So, it's a good place to start. The eventual valuation of a specific piece of property is likely much more or much less than these averages. don't know how to get the whole file attached here.

If you want to wrestle with this here's the link to NASS Ag Stats:

https://quickstats.nass.usda.gov/

Here's a picture the the query build:

And the State of Kentucky Average Estimated Annual Farmland Value per Acre

Annual Percentage Change of the Same

Attachments

Last edited:

SD51555

5 year old buck +

There was an effort to index long term gains for inflation, but there is zero chance of that ever happening. There is going to be a need for more revenue soon, because the parasite class won’t tolerate a haircut.

If we’d disband NATO, bring our troops home, and address the nutrition and health crisis, we could balance the budget and end the inflation immediately. Unfortunately, if peace and good health broke out, our economy would implode.

Sent from my iPhone using Tapatalk

If we’d disband NATO, bring our troops home, and address the nutrition and health crisis, we could balance the budget and end the inflation immediately. Unfortunately, if peace and good health broke out, our economy would implode.

Sent from my iPhone using Tapatalk

Foggy47

5 year old buck +

One thing many do not realize regarding capitol gains on inherted land.......is that in a rapidly raising market like we have had......the assessor that determines market value at death....compared to time you sell......has to have COMPARABLE sales for that time period. If no local farm land has sold....that means he will use 3 (I think) of the most recent sales for the area. If those are a year or two old....then you will pay tax on the gain in those prices from those sale times.

^ This happened to my wife's family farm.....and her sister "forced" a sale....which in a wild market went for a fairly high price at that time. But due to lack of any recent sales in the township or county "we" ended up to pay taxes on much of the gains. Stupid....but that is the way it works. My sister in law was greedy (and not too bright on the details). Still a riff in the family over this.

This was about 8 years ago.....and prices went up substantially since then. Blind greed drove these decisions.

^ This happened to my wife's family farm.....and her sister "forced" a sale....which in a wild market went for a fairly high price at that time. But due to lack of any recent sales in the township or county "we" ended up to pay taxes on much of the gains. Stupid....but that is the way it works. My sister in law was greedy (and not too bright on the details). Still a riff in the family over this.

This was about 8 years ago.....and prices went up substantially since then. Blind greed drove these decisions.

weekender21

5 year old buck +

It’s been interesting watching the value of land in many areas change from timber and agriculture driving the price to recreational driving the price. In the 90’s dirt was cheap in pine timber country and you could actually consider tree farming an investment. Most of the timber land prices in the SE are much higher despite the timber market crash.

I suspect the next 50 years will be interesting to watch as well. If areas start to lose hunting rights I’d imagine land prices would be impacted. I’ve also wondered about CWD’s long term impact. Some of the hardest hit areas have seen significant drops in hunter participation.

Sent from my iPhone using Tapatalk

I suspect the next 50 years will be interesting to watch as well. If areas start to lose hunting rights I’d imagine land prices would be impacted. I’ve also wondered about CWD’s long term impact. Some of the hardest hit areas have seen significant drops in hunter participation.

Sent from my iPhone using Tapatalk

FarmerDan

5 year old buck +

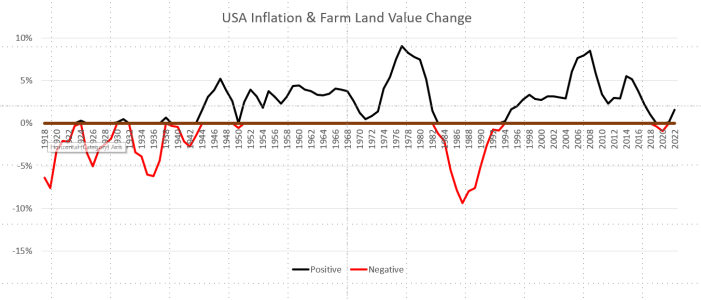

I got one more and then I will let it go - promise!

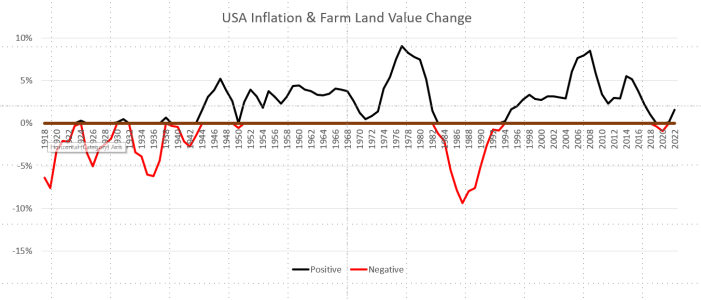

This is the average annual percentage change in farmland value minus the same year rate of inflation. Don't think about it too long.

If the line is black then the increase exceeded inflation. Red the opposite -inflation exceeded the change in farmland value. It's a macro picture. USA generally. Your experience will be different - sorta'!

This is the average annual percentage change in farmland value minus the same year rate of inflation. Don't think about it too long.

If the line is black then the increase exceeded inflation. Red the opposite -inflation exceeded the change in farmland value. It's a macro picture. USA generally. Your experience will be different - sorta'!

Last edited:

SD51555

5 year old buck +

It’s been interesting watching the value of land in many areas change from timber and agriculture driving the price to recreational driving the price. In the 90’s dirt was cheap in pine timber country and you could actually consider tree farming an investment. Most of the timber land prices in the SE are much higher despite the timber market crash.

I suspect the next 50 years will be interesting to watch as well. If areas start to lose hunting rights I’d imagine land prices would be impacted. I’ve also wondered about CWD’s long term impact. Some of the hardest hit areas have seen significant drops in hunter participation.

Sent from my iPhone using Tapatalk

Has CWD dropped the deer population somewhere, or you just saying the state convinced everyone venison is dangerous?

Up here, CWD means you’re in a top notch area for big bucks and big numbers.

Sent from my iPhone using Tapatalk

Foggy47

5 year old buck +

Land may be the best way to "store" value in your investments. If you can get income from that land too....then your golden....IMO. Look at all the wealthy people gobbling up land all over the USA. They ain't doing it because it's a poor investment. Tho managing a large portfolio of land is going to require some work to realize the gains too. Lots of money been made by getting "in front of" a hot growth area.I used to use CWD threat as a reason to be bearish about recreational land as a good place to park money. CWD may be real (not opining on that here) but it hasn’t hurt land prices at all to my watchful eye.

weekender21

5 year old buck +

Has CWD dropped the deer population somewhere, or you just saying the state convinced everyone venison is dangerous?

Up here, CWD means you’re in a top notch area for big bucks and big numbers.

Sent from my iPhone using Tapatalk

I’m not sure states have convinced people it’s dangerous but the media has definitely tried. I certainly understand how casual hunters that just want to put a deer in their freezer annually but aren’t really into it could walk away from their hobby.

Sent from my iPhone using Tapatalk

KJS-ND

Yearling... With promise

I thought the Land Podcast episode on the Structured Installment Sale Annuity also sounded interesting - same benefit of a land contract basically if I'm understanding it correctly, except you get a payment from the financial institution instead of from the buyer. Certainly would give you some control over how much income you take out each year and maybe allow you to reduce or maybe even eliminate the taxes if you structure it properly and have limited other sources of income.Edit: just re-read the original post that the land already sold so the below wont be applicable and with the current rates available with CD's, money market funds, etc the concept doesn't pencil out in as many situations for sellers like it used to.

One thing I heard mentioned on the Land Podcast used as a tool to avoid some capital gains tax particularly for folks on a limited fixed income is Land Contracts. Basically you sign a contract with purchaser for them to pay seller directly in payments over a span of years. Depending on sellers income and tax bracket, capital gains can be reduced or eliminated entirely. From what I gather, in many cases if the buyer fails to pay the land becomes property of the seller in whole without regards to payments previously made. Good deal for sellers who don't need all the money at once for another purchase and good deal for buyers who want to avoid a loan with interest.

If Seller's annual income is less than 44,625 single or $89,250 married, any of those annual payments prior to their income hitting the max $ below would be tax free.

Hoytvectrix

5 year old buck +

On the most recent episode of the Land Podcast, one of the data scientists from Acre.com was on to present a land value report they had created for the Heartland (mostly Midwestern states). They present data for price per acre, per tillable acre, and per productivity index. You can download the report for free from their website, but you need to give them your email. This report mostly includes data relevant to tillable acres, but they do track recreation land on their website. Some of the more interesting things from the report is the presentation of price per productivity index trends across states and time.

As this type of data becomes more and more accessible, I would imagine finding good deals is going to be more and more difficult.

As this type of data becomes more and more accessible, I would imagine finding good deals is going to be more and more difficult.

Foggy47

5 year old buck +

When I see charts like this.....I am reminded that being somewhat colorblind is a bitch. lolOn the most recent episode of the Land Podcast, one of the data scientists from Acre.com was on to present a land value report they had created for the Heartland (mostly Midwestern states). They present data for price per acre, per tillable acre, and per productivity index. You can download the report for free from their website, but you need to give them your email. This report mostly includes data relevant to tillable acres, but they do track recreation land on their website. Some of the more interesting things from the report is the presentation of price per productivity index trends across states and time.

As this type of data becomes more and more accessible, I would imagine finding good deals is going to be more and more difficult.

View attachment 58295

Edit: If the author would just list the states and colors in order from top to bottom it would give a guy like me a fighting chance.....grin.

Wind Gypsy

5 year old buck +

On the most recent episode of the Land Podcast, one of the data scientists from Acre.com was on to present a land value report they had created for the Heartland (mostly Midwestern states). They present data for price per acre, per tillable acre, and per productivity index. You can download the report for free from their website, but you need to give them your email. This report mostly includes data relevant to tillable acres, but they do track recreation land on their website. Some of the more interesting things from the report is the presentation of price per productivity index trends across states and time.

As this type of data becomes more and more accessible, I would imagine finding good deals is going to be more and more difficult.

View attachment 58295

Interesting that MN, IL, and IN are that much lower! I wonder if the scales used by each state are apples to apples or at least close? Maybe there are other attributes like drainage, topography, and farmability built in?

Similar threads

- Replies

- 6

- Views

- 578