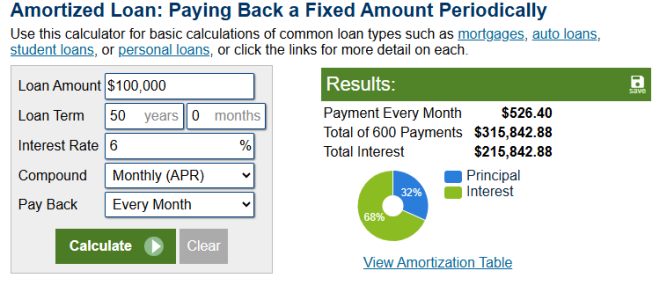

^ Good discussion....HOWEVER......IF (and that is a capital IF) inflation persists the way it has during my life....then that home you paid $100,000 for ....may be worth FAR more than the price you paid. Like 10x the price. Therefore, finding a way to gain equity ownership may trump the interest you pay. Plausible.....and many people bank on that reality.

Thus....that home may never meet your payment expectations. As I have said to my grandids.....you can bank on inflation. Plan for it.

I'm reminded of a saying from a book I once read: "Buy quality things of lasting value". Seems to me real estate qualities for that....and new pickup trucks do not.