buckvelvet

5 year old buck +

VOLT has some high expense ratio I see at $7.50 per $1000...My best performing ETF's have been VOLT and XME, both up almost 20% ytd. They aren't tech heavy so add some diversity to the mix.

VOLT has some high expense ratio I see at $7.50 per $1000...My best performing ETF's have been VOLT and XME, both up almost 20% ytd. They aren't tech heavy so add some diversity to the mix.

You are correct. It also would have earned $480 in the past year for that $1000 investment.VOLT has some high expense ratio I see at $7.50 per $1000...

Not disputing your return the fee strength just surprised me.You are correct. It also would have earned $480 in the past year for that $1000 investment

See chevron inching up more. I'll hold it.

Gold used to be safety net, now it's a trampoline.

Keeping 5-10% vxus as a safety net? This is leisure money outside of retirement stuff.

Wonder what the excuse is today for the markets tanking?

Yeah, I’ve been buying the Amazon dip. Will be interesting to see what today brings.

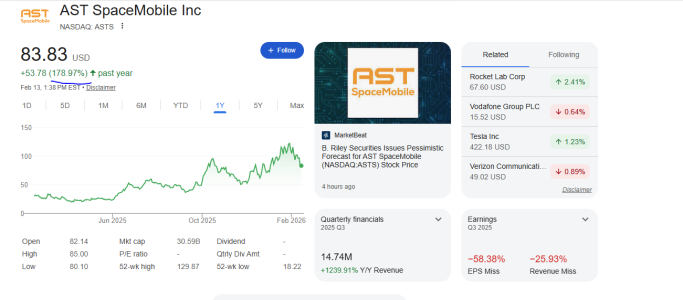

Am I missing something, or did I look at the wrong ticker?I went in on ASTS. Haven't seen it this low for some time. All I can figure out about the price drop was an article about raising another billion dollars and I'm hoping that's what caused the panic by investors. It was climbing pretty consistently before the "news" that I would consider good news. Makes no sense to me.

Anyone who thinks MSTR is going to come back up,now is the time to buy in my opinion. It's around $133 now with a target price of around $360.