bigboreblr

5 year old buck +

Any other modern society countries sort of like ours had their currency tank? Think Greece has some merit to look into, but might be a bit small, globally remote far as economy impact goes. Not sure their mix of rural to suburban goes. Country folk can survive. Just a good year to make the garden bigger or add another goat........

Ireland took a tank awhile back? Russia might be hard to get honest info about. But, its a mix of bad economy and government involvement, both internal and external.

Been reading up on the dot com bust and 2008 bust, what went bad, what came out good. Since the internet online stuff got big, now we have a flurry of amateurs like me seeing the yo-yo go up n down every minute on their phones. That has to be amplfying changes. I am looking at a stock I sold 3 weeks ago.. Need to read up on the 1987 and going into 1987 Reaganomics thing..... That might show what military spending has on some stocks. Heard some real whacky stuff from old navy guys about the 80's. That cowboy was trigger happy.

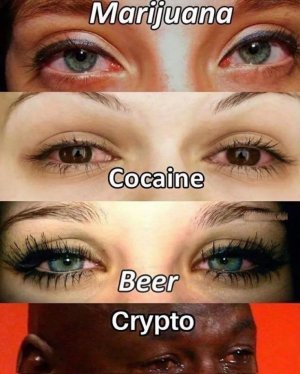

What do you guys think of decent looking companies when you see p/e ratios of 8-15, or what you think might be up an comers with a p/e ratio of like -3 to -10. Also, anybody have a high limit, like some of these AI / Tech big bombs are 46 or even like 60. I'm way too stock dumb to be playing a quick game right now. But hold on to it a few months until you make 15-20% kinda thing. Nothing wrong with making an extra 6 pack with your beer money.

Ireland took a tank awhile back? Russia might be hard to get honest info about. But, its a mix of bad economy and government involvement, both internal and external.

Been reading up on the dot com bust and 2008 bust, what went bad, what came out good. Since the internet online stuff got big, now we have a flurry of amateurs like me seeing the yo-yo go up n down every minute on their phones. That has to be amplfying changes. I am looking at a stock I sold 3 weeks ago.. Need to read up on the 1987 and going into 1987 Reaganomics thing..... That might show what military spending has on some stocks. Heard some real whacky stuff from old navy guys about the 80's. That cowboy was trigger happy.

What do you guys think of decent looking companies when you see p/e ratios of 8-15, or what you think might be up an comers with a p/e ratio of like -3 to -10. Also, anybody have a high limit, like some of these AI / Tech big bombs are 46 or even like 60. I'm way too stock dumb to be playing a quick game right now. But hold on to it a few months until you make 15-20% kinda thing. Nothing wrong with making an extra 6 pack with your beer money.