-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

hunts_with_stick

5 year old buck +

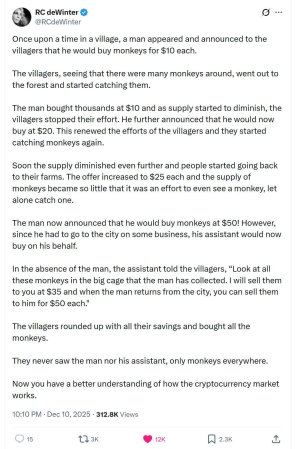

Pretty interesting…. Probably could be said for a number of things

buckvelvet

5 year old buck +

Idk how close you are but the holidays are coming and he could gift some to a guy in MI no strings...... I take paypal.Yes. The family owned slot machine distribution and they kept a bunch of silver dollars from years ago . Bags & chests full of of them . They also owned several casinos . Without tipping them off, they were owners of casinos in MN, SD & Mississippi…

They own silver and gold bars as well . They don’t even know how much they have . Lots of cash & stock as well. . My buddy stands to inherit 1/3 of it …

Foggy47

5 year old buck +

Fun! Congrats.

Foggy47

5 year old buck +

Yep....how about the event with the Hunt's and silver. Lots of traps been set over the years.Pretty interesting…. Probably could be said for a number of things

Bowsnbucks

5 year old buck +

Variations of pump-and-dump. Stir up lots of excitement, convince the herds to join the exciting, upward rush ....... then sell quick at a huge gain.

jsasker007

5 year old buck +

Market manipulation at it's finest. So many things going on that are not legal but laws are pretty much meaningless anymore. SADVariations of pump-and-dump. Stir up lots of excitement, convince the herds to join the exciting, upward rush ....... then sell quick at a huge gain.

buckvelvet

5 year old buck +

Bowsnbucks

5 year old buck +

Go with a fee-only, fiduciary CFP - with papers to prove he's a fiduciary. Independent CFP, so he/she has no personal ax to grind by selling you products that benefit them (commissions) more than you. I'd never go with a financial advisor who operates on a % basis.

buckvelvet

5 year old buck +

I don't have an FA or a CFP, I just thought it was a good article.Go with a fee-only, fiduciary CFP - with papers to prove he's a fiduciary. Independent CFP, so he/she has no personal ax to grind by selling you products that benefit them (commissions) more than you. I'd never go with a financial advisor who operates on a % basis.

Westwind

5 year old buck +

My wife used advisors. The last one was a Schwab advisor that took a fraction of a percent of the gains. Sounded miniscule. We were busy with demanding jobs and kids.

It grew. It didn’t grow like it grew when I took it over and used very vanilla low cost index funds and a couple managed low cost index funds. It frigging grew spectacularly compared to the maze of managed funds we had before.

These fees eat you alive. You probably don’t need them. Don’t beat the market, BE the market. Low cost index funds beats managers over time.

It grew. It didn’t grow like it grew when I took it over and used very vanilla low cost index funds and a couple managed low cost index funds. It frigging grew spectacularly compared to the maze of managed funds we had before.

These fees eat you alive. You probably don’t need them. Don’t beat the market, BE the market. Low cost index funds beats managers over time.

Westwind

5 year old buck +

Terry Savage: “A 20-something who saved $40 per week invested for 50 years at the historic average stock-market return (~10% annually, with dividends reinvested) could accumulate nearly $2.5 million by retirement. In contrast, someone who started later (e.g., age 37) ends up with far less over a shorter period. This illustrates how even relatively small, consistent contributions early in life can grow to substantial wealth over the long term thanks to compound growth.”

All low cost index funds. She said this on the radio awhile back and people wanted to argue with her. People are stupid.

All low cost index funds. She said this on the radio awhile back and people wanted to argue with her. People are stupid.

Last edited:

BuckSutherland

5 year old buck +

Rocket Lab has been screaming higher. You could have bought it under $40 less than a month ago. Today they announced they landed huge contract to launch satellites into space. Fifteen months ago the stock was under $5. ALMOST pulled the trigger on 1,000 shares back then but chickened out cause I already had a couple hundred shares underwater at $12.xx. Oh well. Not interested in buy any additional at these levels.

Wind Gypsy

5 year old buck +

Who needs to manufacture pennies? just need these guys to drop off their barrels haha!I know a guy that has four 50 gal barrels full of coins. Mostly quarters. Estimates say about 4mm in there

Only problem I would like to enjoy being a millionaire before 75 years old, so maybe start taking a percentage out at a younger age.Terry Savage: “A 20-something who saved $40 per week invested for 50 years at the historic average stock-market return (~10% annually, with dividends reinvested) could accumulate nearly $2.5 million by retirement. In contrast, someone who started later (e.g., age 37) ends up with far less over a shorter period. This illustrates how even relatively small, consistent contributions early in life can grow to substantial wealth over the long term thanks to compound growth.”

All low cost index funds. She said this on the radio awhile back and people wanted to argue with her. People are stupid.

Wind Gypsy

5 year old buck +

Only problem I would like to enjoy being a millionaire before 75 years old, so maybe start taking a percentage out at a younger age.

Contribute more than $40/week - voila.

For folks with an employer contribution match 401k, $40/week is less than I'd expect most would be seeing invested just by contributing enough to get most of their employer match.

Similar threads

- Replies

- 18

- Views

- 587

- Replies

- 13

- Views

- 900