-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

S.T.Fanatic

5 year old buck +

Guessing nobody jumped onto Bobcat this spring because of the high per share stock price?

Bowsnbucks

5 year old buck +

Bogle and Buffet do say the market is speculation!! But for individual stock pickers like Buffet, - absolutely he looks for value at a good price. But in the aggregate, if investors - whoever they might be - decide a stock, or a sector, or the market as a whole are not the place to be, what was perceived prior to that as a solid investment can go down the drain in seconds - literally. Even Buffet isn't immune to that risk - no matter how deep his research before buying - and he DOES say there is risk in all investing. The key is to minimize as much risk as possible. Big players like Buffet can afford to lose 30% of his portfolio .......... he'll still have billions to play with. I'd venture to say that most of us on this forum don't have that many chips to "play" with, and 30% loss (or more) would cause sleepless nights. We won't have multiple millions or billions left in our accounts as a cushion.Your first statement contradicts the rest. It's not speculation. If you pay attention to Buffett you will hear him say again and again that price vs. Value is exactly how he picks stocks.

Many different events can cause a market to crash in a VERY short time frame .......... so all the research & digging through company balance sheets can't shield anyone from a crash (when investors lose faith & pull money out ........ for whatever reason). Even after extensive stock research, all of us are still "speculating" that we'll come out with a gain when we invest dollars. Even Bogle & Buffet. I've read their books and articles for years, and they both talk minimizing risks - AND keeping investment costs LOW.

Last edited:

Bowsnbucks

5 year old buck +

As a sidelight, a recent study by a panel of financial planners, which took into account avg. inflation, avg. cost of living, insurance costs, medical coverage, etc. - concluded that the OLD benchmark of having $1 million saved when one retires falls short of reality. The new benchmark is $1 1/2 million dollars to have a decent measure of security and retain your "quality of life." They emphasize that's barring any major health events / costs out of pocket.

In order to live TODAY, and still have enough left to save / invest for your future (and that $1 1/2 million goal), that's impossible to achieve earning pay that was good back in 1985. Many, MANY people today are STILL being paid wages that were decent to raise a family in 1985!! And today's cost of living is MUCH higher than in 1985, plus we have more out-of-pocket medical, dental & eye care expenses than we had then. Deductibles are all rising at every turn ........... and pay has been lagging for several decades now. HARSH FACTS - straight from math-savvy folks. Numbers don't know politics - they are what they are.

The best answer to these problems is to pick a field of expertise that PAYS really well, and save at least 15% of your income from day 1. Dollar-cost-avg. your money into to low-cost investment vehicles, automatically reinvest the dividends and interest .......... and STAY THE COURSE. Time is your friend .......... the sooner you get started - the more you end up with later. Rotten pay will NOT get you there if you don't have much - or ANY - disposable income money to invest. ( This is the advice financial planners give to MOST people of avg. means. Much higher income gives you more choices. )

In order to live TODAY, and still have enough left to save / invest for your future (and that $1 1/2 million goal), that's impossible to achieve earning pay that was good back in 1985. Many, MANY people today are STILL being paid wages that were decent to raise a family in 1985!! And today's cost of living is MUCH higher than in 1985, plus we have more out-of-pocket medical, dental & eye care expenses than we had then. Deductibles are all rising at every turn ........... and pay has been lagging for several decades now. HARSH FACTS - straight from math-savvy folks. Numbers don't know politics - they are what they are.

The best answer to these problems is to pick a field of expertise that PAYS really well, and save at least 15% of your income from day 1. Dollar-cost-avg. your money into to low-cost investment vehicles, automatically reinvest the dividends and interest .......... and STAY THE COURSE. Time is your friend .......... the sooner you get started - the more you end up with later. Rotten pay will NOT get you there if you don't have much - or ANY - disposable income money to invest. ( This is the advice financial planners give to MOST people of avg. means. Much higher income gives you more choices. )

S.T.Fanatic

5 year old buck +

We have a small company with less than 10 employees receiving insurance benefits. (we pay 100% of our employees insurance) our rates went up 15K this past year alone!

SD51555

5 year old buck +

The math is moving a lot faster than that. Not only will people need more money because the dollar is collapsing, they're also going to need 2-3x as much due to how hard it's going to be to make any risk free income. In the old days, you could probably make it with a million and and assumed risk free rate of income of 5%.As a sidelight, a recent study by a panel of financial planners, which took into account avg. inflation, avg. cost of living, insurance costs, medical coverage, etc. - concluded that the OLD benchmark of having $1 million saved when one retires falls short of reality. The new benchmark is $1 1/2 million dollars to have a decent measure of security and retain your "quality of life." They emphasize that's barring any major health events / costs out of pocket.

In order to live TODAY, and still have enough left to save / invest for your future (and that $1 1/2 million goal), that's impossible to achieve earning pay that was good back in 1985. Many, MANY people today are STILL being paid wages that were decent to raise a family in 1985!! And today's cost of living is MUCH higher than in 1985, plus we have more out-of-pocket medical, dental & eye care expenses than we had then. Deductibles are all rising at every turn ........... and pay has been lagging for several decades now. HARSH FACTS - straight from math-savvy folks. Numbers don't know politics - they are what they are.

The best answer to these problems is to pick a field of expertise that PAYS really well, and save at least 15% of your income from day 1. Dollar-cost-avg. your money into to low-cost investment vehicles, automatically reinvest the dividends and interest .......... and STAY THE COURSE. Time is your friend .......... the sooner you get started - the more you end up with later. Rotten pay will NOT get you there if you don't have much - or ANY - disposable income money to invest. ( This is the advice financial planners give to MOST people of avg. means. Much higher income gives you more choices. )

The real retirement cheese is in figuring out how to generate income in an environment where there is very little to be had, at least on the risk free front. My goal is to draw income only, and leave 10-20% of the income generated in the portfolio to hedge up against inflation in case I don't croak on time.

If you can pull down 6-11% income and dodge the tax man, that could chop 10-20 years off the time you need to work. That's where I focus my energy.

S.T.Fanatic

5 year old buck +

Any heaven forbid one would be able to leave some money for their Kids. I guess that would be considered "white privilege" and wrong.

Gator

5 year old buck +

I think Tesla is headed for a correction. I won't go back to it. It was a wild ride, but the stock is artificially propped up, and their competitors are taking more and more market share.

I agree it’s likely headed for one but I’m on board until that correction starts and loving watching it rise daily

Sent from my iPhone using Tapatalk

Bowsnbucks

5 year old buck +

Yes. Bond yields SUCK, and have sucked for a while now, so income won't be risk free. It used to be you could count on bond yields to buck up your income, but not anymore. CD rates also SUCK. Dividend payers with good records of steady - and better yet, INCREASING dividend payouts - will probably be the best bet. But being able to ride out a market downturn will be important if the stock prices decline. If you have to sell stocks, kiss your capital appreciation gains goodbye.The math is moving a lot faster than that. Not only will people need more money because the dollar is collapsing, they're also going to need 2-3x as much due to how hard it's going to be to make any risk free income. In the old days, you could probably make it with a million and and assumed risk free rate of income of 5%.

The real retirement cheese is in figuring out how to generate income in an environment where there is very little to be had, at least on the risk free front. My goal is to draw income only, and leave 10-20% of the income generated in the portfolio to hedge up against inflation in case I don't croak on time.

If you can pull down 6-11% income and dodge the tax man, that could chop 10-20 years off the time you need to work. That's where I focus my energy.

chummer

5 year old buck +

No need to worry about that. Hefty inheritance tax coming your via the squad.Any heaven forbid one would be able to leave some money for their Kids. I guess that would be considered "white privilege" and wrong.

Tree Spud

5 year old buck +

No need to worry about that. Hefty inheritance tax coming your via the squad.

Trusts

Bill

Administrator

Gator

5 year old buck +

I would sell Twitter stock if you have any !

Millions are cancelling accounts or being banned.

What about FB or apple?

Sent from my iPhone using Tapatalk

bwoods11

5 year old buck +

As a large Apple shareholder I’m very concerned. If the left convinces Apple to cancel apps, choose political sides. Than I might sell all my shares.What about FB or apple?

Sent from my iPhone using Tapatalk

I doubt Tim Cook would be that stupid?

Gator

5 year old buck +

As a large Apple shareholder I’m very concerned. If the left convinces Apple to cancel apps, choose political sides. Than I might sell all my shares.

I doubt Tim Cook would be that stupid?

I’ve heard apple has already pulled the app Parler (the conservative’s FB). I have not confirmed

Sent from my iPhone using Tapatalk

S.T.Fanatic

5 year old buck +

I doubt apple is going anywhere but up

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

bwoods11

5 year old buck +

Depends on how far they go and if they choose sides. Samsung would be laughing all the way to the bank.I doubt apple is going anywhere but up

Sent from my iPhone using Tapatalk

SD51555

5 year old buck +

We're very close to the entire market topping the gross overvaluation of the dot com implosion. What's different this time, is it's a battle of the federal reserve vs market forces. I'm betting on the federal reserve for now. I spent 8 years betting against the fed and instead on market forces. Got my shorts stuffed in my mouth on that deal. They're going to destroy the dollar, working class, and the economy, all to keep the debt from going bad.

In 2005, the federal government was in the hole by $100B. Katrina hit and added $150B to that. Currency hawks thought that was the end. Then 2008 happened and we saw the biggest ever stimulus at $800B. Currency hawks thought that was the end. Then the rona was unleased and we've pumped out $4T (trillion) plus many other trillions in hidden fed action. If another 12 years go by, the stimulus in 2032 will need to be about $27 trillion dollars. Have no fear, we'll have the $15 minimum wage by then.

The stimulus always has to be bigger than the last to keep it going. Nobody fails.

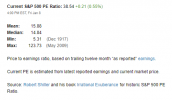

This is a p/e chart back to 1870. So long as the silhouette in the window keeps pumping a trillion + dollars every 60 days, we'll probably keep going. But that isn't a straight line. It has to be exponential, or the previous debts will swamp the effect of the new debts.

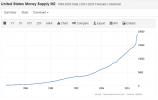

The money supply curve was already turning more sharply north before the rona. It's gonna turn faster now. I can't help but keep thinking this is much like that scene from Wolf of Wall Street where the yacht goes down.

In 2005, the federal government was in the hole by $100B. Katrina hit and added $150B to that. Currency hawks thought that was the end. Then 2008 happened and we saw the biggest ever stimulus at $800B. Currency hawks thought that was the end. Then the rona was unleased and we've pumped out $4T (trillion) plus many other trillions in hidden fed action. If another 12 years go by, the stimulus in 2032 will need to be about $27 trillion dollars. Have no fear, we'll have the $15 minimum wage by then.

The stimulus always has to be bigger than the last to keep it going. Nobody fails.

This is a p/e chart back to 1870. So long as the silhouette in the window keeps pumping a trillion + dollars every 60 days, we'll probably keep going. But that isn't a straight line. It has to be exponential, or the previous debts will swamp the effect of the new debts.

The money supply curve was already turning more sharply north before the rona. It's gonna turn faster now. I can't help but keep thinking this is much like that scene from Wolf of Wall Street where the yacht goes down.

Similar threads

- Replies

- 18

- Views

- 549

- Replies

- 13

- Views

- 890