SD51555

5 year old buck +

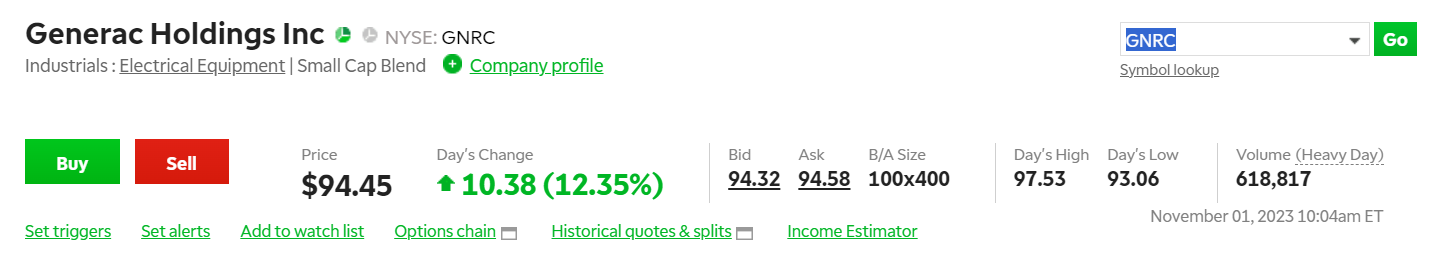

Bonds are still a loser at the moment, but the ultra short term treasuries are a nice place to hide out while the market continues to decline. There are lots in my watch list that are hitting their 52 week lows and still diving: UPS, Tractor Supply, Generac, Medtronic, Home Depot, Clorox, Conagra, General Mills, Genuine Parts Company, Xcel Energy, Wisconsin Energy, Morgan Stanley, Rumble, Archer Daniels, Kimberly Clark, Tyson Foods, US Bank, Texas Instruments...

You gotta beat inflation, that's the bottom line. I'm figuring on 10% now. If you're not getting 10%, you're falling behind. The uni-party has been cutting benefits all along by underreporting inflation and driving the dollar into the ground. I imagine the only entities still holding long term treasuries are those that hold the guaranteed sale option from the fed.

You gotta beat inflation, that's the bottom line. I'm figuring on 10% now. If you're not getting 10%, you're falling behind. The uni-party has been cutting benefits all along by underreporting inflation and driving the dollar into the ground. I imagine the only entities still holding long term treasuries are those that hold the guaranteed sale option from the fed.