-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

Telemark

5 year old buck +

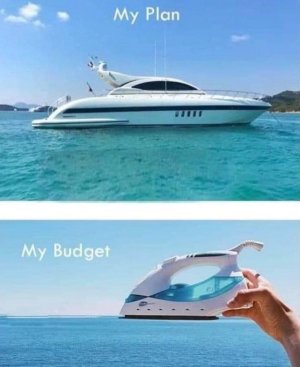

$2M today isn't even the $1M of 2000. Ain't nobody in their 40s or 50s buying a yacht and kickin' it at $2M

I'm never buying a yacht. I'm buying a fishing boat.

A Roth IRA with 2 million at a 5% dividend rate is 100k in cash per year, tax free. I can easily live on that with some left over to reinvest.

Bill

Administrator

I have a decent boat and I’m going to be OK. But my son and I drive by some really big sport fishing boats. Like $5 million dollar boats and dream.

Not happening for me but I tell him good for them! That’s capitalism. If we lived under socialism we’d all be on the bank of the ocean wishing we could cast further.

Not happening for me but I tell him good for them! That’s capitalism. If we lived under socialism we’d all be on the bank of the ocean wishing we could cast further.

Foggy47

5 year old buck +

At nearly 80 now...and with the ability to own a yacht (maybe a small one?)....I can truthfully say "I do not want one". Just another money pit and high maintenance item that one can do without. Still, I can appreciate someone that wants to achieve such status.....more power to you. For me, Life's simple pleasures are still foremost....and sometimes hardest to find.$2M today isn't even the $1M of 2000. Ain't nobody in their 40s or 50s buying a yacht and kickin' it at $2M

Maybe that yacht would be a dream if I lived at the ocean? But, at this point in time, I don't think so.

Foggy47

5 year old buck +

Some folks down the lake from me are pretty rich. He owned Deluxe Check.....when checks were hot and he had that market pretty much to himself....and then sold at the right time. Made many millions. They had built the largest aluminum hulled yacht in the world (?) at that time, I think. ....and travel the globe with it....often flying to meet the yacht in distant lands for a sail. Seems to me he paid over 20 million for it...after a two year build. This was about ten plus years ago. Had a crew of about 7 or 8 and a chef that traveled with them, etc. They also owned BIR for their son (whom later died diving off that yacht). Nice people.

He would rather spend his days at the race track....and loved all things mechanical. Not sure where they are these days....but really nice people with waaaay too much money. I think they were living in Naples, FL and "gave" the track to his son's wife. Strange knowing someone like that. You would not know they were loaded like that. Not sure they were any happier than the next guy.....but they were nice folks.

He would rather spend his days at the race track....and loved all things mechanical. Not sure where they are these days....but really nice people with waaaay too much money. I think they were living in Naples, FL and "gave" the track to his son's wife. Strange knowing someone like that. You would not know they were loaded like that. Not sure they were any happier than the next guy.....but they were nice folks.

Telemark

5 year old buck +

Not happening for me but I tell him good for them! That’s capitalism. If we lived under socialism we’d all be on the bank of the ocean wishing we could cast further.

That's how I was raised. That's why I'd be happy with my 2 mil and go live my life comfortably and enjoy my hobbies and spend time with my family. I really have no use for fancy things, and I'd probably just stress out worrying about expensive toys rather than enjoying them.

bigboreblr

5 year old buck +

MY old plan A retirement gig was to buy a dinner cruise boat or fishing charter. My captain's license is good for 50 tons, also got engineer's license unlimited hp. We're all one bad day away from running the valdez in Alaska. Another fine SUNY Maritime graduate.....I'm never buying a yacht. I'm buying a fishing boat.

A Roth IRA with 2 million at a 5% dividend rate is 100k in cash per year, tax free. I can easily live on that with some left over to reinvest.

I like the you need X to retire gigs. 1 2 3 million......... 6 years I get a pension, 10 years get a full one (30 yrs).

What would you guys do to get a solid 15% return? Sweetening the pot for a vacation property. Could take what I need from my IRA both principal? Also thought of not messing with the horse races as much and just hit retirement fund hard and finding a good ETF. Got a few shares in a couple just to keep watch on them.

I do like a bit of the NYSE roulette wheel. Seems If I am into watching that, I am more mindful of what I spend on the outside.

bwoods11

5 year old buck +

The withdrawal portion at retirement is always interesting! My plan is to use dividends, cash rent and the sale of a business to fund it. Not sell the land or stock , just use the income… cross fingers!!

Thats the goal anyway. My problem is I’m kind of addicted to picking up a parcel of land here and there. So can I really retire? The goal is to work another 8 years. I live in MN now but might be a resident elsewhere in retirement.

Thats the goal anyway. My problem is I’m kind of addicted to picking up a parcel of land here and there. So can I really retire? The goal is to work another 8 years. I live in MN now but might be a resident elsewhere in retirement.

Foggy47

5 year old buck +

We have had some thought provoking discussions on this site about planning and retirement. Strange to hear of all the dreams and reality checks facing us all. One thing I have learned is that retirement in the right state can play a huge role in finances. The community property law states (I think there are nine of them) can provide some significant advantages for taxes. I suggest you read more about that or ask some planners.The withdrawal portion at retirement is always interesting! My plan is to use dividends, cash rent and the sale of a business to fund it. Not sell the land or stock , just use the income… cross fingers!!

Thats the goal anyway. My problem is I’m kind of addicted to picking up a parcel of land here and there. So can I really retire? The goal is to work another 8 years. I live in MN now but might be a resident elsewhere in retirement.

SD51555

5 year old buck +

$100K in 20 years will have the purchasing power of less than $60K today, assuming 3% inflation.

That’s gonna be the trick to staying ahead. If inflation runs hotter and hotter, and it will, all projections will get smashed. Assets as a measure of wealth in retirement is being replaced by the ability to generate enough growth to outrun inflation.

If you’re retired today, can you raise your withdrawal amount 1% a month? Because that’s going to be what’s necessary to maintain your standard of living. Thats at today’s rates of inflation. What if that goes to 1.5% or 2%?

That’s the stress test for plans.

Sent from my iPhone using Tapatalk

I have some cash that I was planning to put toward my land loan, but I’ve recently gotten a rate adjustment that makes the effective rate a touch over 6%. How would you deploy that, between stock market (think VTI), land note pay-down, needed improvements that likely improve land equity dollar for dollar?

FWIW, 80% of my net worth (not including home equity) is deployed to the market. Land equity is about 15% and land debt is about half as much as my equity. Monthly cash flow is very favorable for now, but I’m still not used to having this note. I’m leaning heavily to doing the improvements but that’ll chew up less than a third of the cash.

FWIW, 80% of my net worth (not including home equity) is deployed to the market. Land equity is about 15% and land debt is about half as much as my equity. Monthly cash flow is very favorable for now, but I’m still not used to having this note. I’m leaning heavily to doing the improvements but that’ll chew up less than a third of the cash.

Brian662

5 year old buck +

How much you need really just boils down to how much you'll spend. If the spending is minimal the overall savings can be much lower. IMO, if you have a million in retirement accounts and can't make it, you probably have a spending problem. There are millions of people retired now with little to nothing more than social security, getting by somehow.

In my current case, my spending would be too high until my home/properties are paid off. That will be in the next 5-7 years and we'll reassess at that time.

Like @bwoods11 has alluded to, we are planning to leave MN when our careers are over.

In my current case, my spending would be too high until my home/properties are paid off. That will be in the next 5-7 years and we'll reassess at that time.

Like @bwoods11 has alluded to, we are planning to leave MN when our careers are over.

Howboutthemdawgs

5 year old buck +

I’ll never be able to retire cause apparently I have an addiction to land. I suppose I could liquidate my land and not really worry about working too much but I’d be a miserable Sonofabitch if I didn’t have property so I reckon I’ll keep on working.

Howboutthemdawgs

5 year old buck +

bwoods11

5 year old buck +

I have one in Iowa, it can be a nice option.If you have a self-directed IRA, you can buy land inside your portfolio and not have to pay income tax. If you're a land guy, set up and IRA and use it to buy land. It also helps protect it.

Once my mom decides she is ready to move out of my place in Commerce, I will sell it, then either pay off the remainder of my primary residence (owe around $60K now), or sell it and move to the farm for a few years. Then sell the farm and retire. Will most likely wind up in the mountains or somewhere closer to the salt water and reinvest the remainder to live off of.

Foggy47

5 year old buck +

Gonna drop this here. 5 or 6 years ago.....we moved our residence to AZ.....which has community property laws. <-- THIS is a BIG DEAL. There are 9 such states....and this could be important to you, or your loved ones. We have been retired for over 20 years when my wife passed in Dec. A sad event for certain.

We had sold our home in MN this year....and MN is taxing me on the gain of some pretty big money as that home had appreciated in value big time.. I think it will cost me $500 k +/- in capitol gains tax. It's gonna bite....but we knew that and decided to do so anyway.

We also had accumulated over 4 million in capitol gains on our stock holdings over that time. Our planner was having allot of difficulty not incurring taxes on our trades these days as we also needed some income. Because we now live in a community property state.....those gains will go un-taxed to me and my basis will be "stepped up" to current values as of the date of my wife's death in December. Her gains....AND MINE!. So I just avoided over a million dollars in capital gains tax....by living in AZ instead of MN. Like a fresh start on our stock investments. Poof....all gains are erased....tax free. Legal....legit.....gone.

Not saying this to flaunt or brag....just wanting to let you know there are often better tax situations available, if you look for them. I wonder how much tax I have already paid to get to the values we attained in our holdings?.....LOTS! ...I expect. Anyway.......

If I owned allot of land in MN with a large amount of capitol gains.....I may consider selling my MN land.....and investing those dollars via a 1031 exchange......to a state with community property laws. Thus at the passing of one of the owners....the stepped up basis would be attained on that land. No capitol gains taxes....you or your spouce could sell the land without incurring that tax after the death of your partner. (same as for stocks or other investments).

Of course....you need to LIVE there for six months of each year. Not hard to do if you chose a good destination. We like AZ.

I do not think many people are aware of this....and the potential huge implications to you....or your spouce. Think of all those family farms that have been held for 50 years or more.....with a basis of pennies on the dollar! Many do not sell because of taxes that would be incurred. While nobody wants to die to save taxes....the community property law allows a means to avoid allot of tax on property or stocks that have appreciated in value. Easy changes to make.....just by living in another state.

I just saved my family over 1 million + + in taxes when I pass along.....as well as further savings at my demise. Seems kinda cold to write this....but it is what it is....and I only hope my experience can help someone else. Death and taxes are quite real. Some states are superior to others. Minnesota ain't one of 'em. Minnesota and some other states like California would like to charge you an "exit tax"....which is illegal....or they would do it.) Just saying. (kinda hate writing this...I just want to help others find some light at the end of the tunnel.)

We had sold our home in MN this year....and MN is taxing me on the gain of some pretty big money as that home had appreciated in value big time.. I think it will cost me $500 k +/- in capitol gains tax. It's gonna bite....but we knew that and decided to do so anyway.

We also had accumulated over 4 million in capitol gains on our stock holdings over that time. Our planner was having allot of difficulty not incurring taxes on our trades these days as we also needed some income. Because we now live in a community property state.....those gains will go un-taxed to me and my basis will be "stepped up" to current values as of the date of my wife's death in December. Her gains....AND MINE!. So I just avoided over a million dollars in capital gains tax....by living in AZ instead of MN. Like a fresh start on our stock investments. Poof....all gains are erased....tax free. Legal....legit.....gone.

Not saying this to flaunt or brag....just wanting to let you know there are often better tax situations available, if you look for them. I wonder how much tax I have already paid to get to the values we attained in our holdings?.....LOTS! ...I expect. Anyway.......

If I owned allot of land in MN with a large amount of capitol gains.....I may consider selling my MN land.....and investing those dollars via a 1031 exchange......to a state with community property laws. Thus at the passing of one of the owners....the stepped up basis would be attained on that land. No capitol gains taxes....you or your spouce could sell the land without incurring that tax after the death of your partner. (same as for stocks or other investments).

Of course....you need to LIVE there for six months of each year. Not hard to do if you chose a good destination. We like AZ.

I do not think many people are aware of this....and the potential huge implications to you....or your spouce. Think of all those family farms that have been held for 50 years or more.....with a basis of pennies on the dollar! Many do not sell because of taxes that would be incurred. While nobody wants to die to save taxes....the community property law allows a means to avoid allot of tax on property or stocks that have appreciated in value. Easy changes to make.....just by living in another state.

I just saved my family over 1 million + + in taxes when I pass along.....as well as further savings at my demise. Seems kinda cold to write this....but it is what it is....and I only hope my experience can help someone else. Death and taxes are quite real. Some states are superior to others. Minnesota ain't one of 'em. Minnesota and some other states like California would like to charge you an "exit tax"....which is illegal....or they would do it.) Just saying. (kinda hate writing this...I just want to help others find some light at the end of the tunnel.)

Last edited:

Similar threads

- Replies

- 18

- Views

- 540

- Replies

- 13

- Views

- 880

- Replies

- 6

- Views

- 426

- Replies

- 8

- Views

- 469