bigboreblr

5 year old buck +

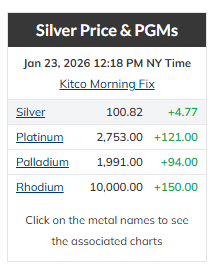

Think gold or silver is still worth buying at this point?

Been worried about the debt ceiling for a few years now. I see where those bonds would be a good spot.

Been worried about the debt ceiling for a few years now. I see where those bonds would be a good spot.