-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

Telemark

5 year old buck +

I have a Fidelity account. They let you see pre-market.

That's a good point. I used to trade with Active Trader, but the new Trader+ software is not good for day trading. If they add hotkeys it will be well worth using, since they don't charge commission.

BenA

5 year old buck +

I'm just learning, so hot keys may get me in trouble. I like the safety net of putting in conditional orders with defined limits. I could see getting to the point where I would want to do that faster though. It does take longer, which is aggravating some times.That's a good point. I used to trade with Active Trader, but the new Trader+ software is not good for day trading. If they add hotkeys it will be well worth using, since they don't charge commission.

Telemark

5 year old buck +

I'm just learning, so hot keys may get me in trouble. I like the safety net of putting in conditional orders with defined limits. I could see getting to the point where I would want to do that faster though. It does take longer, which is aggravating some times.

They should have programmable hotkeys that allow you to set them up with all the conditions you want. It lets you get into, and more importantly out of, a trade in milliseconds. You can use market orders during market hours, and during extended sessions you can buy and sell with limit orders on the ask or the bid with an offset to make sure your orders get filled. The problem with entering everything manually is the price might go past your limit before you are done filling out your order ticket.

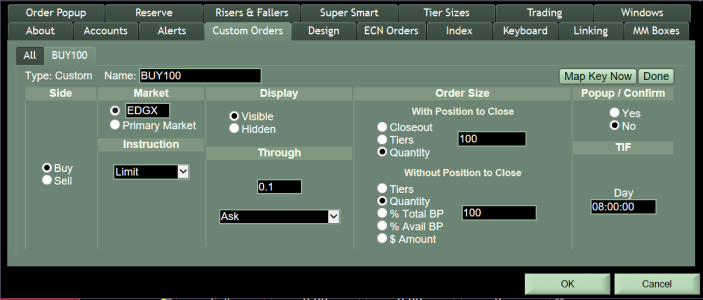

This is how it looks on the Lightspeed platform. You create the order, and then you can map a button on your workstation or click on the Keyboard tab to program hotkeys. It's essential for momentum trading, which is what I am trying to focus on. It just allows me to be more flexible with working hours, since I trade from different time zones. If I want to hold something overnight, or trade/invest on a longer timeline, I use my Fidelity account. Both accounts are set up to trade on margin, and I can trade options, too. I actually prefer trading options on Fidelity.

The Fidelity platform is good to learn on, since it's simple but has most of the functions a trader would need. I use the trailing stoploss on a lot of my positions, especially if it's something with higher risk. Another thing I will say about Fidelity is they are extremely professional, and their customer service is excellent.

Telemark

5 year old buck +

It's only 04:06 in New York, and already ACCL made a nice move on decent volume. I probably could have done something with it, but I was goofing around and missed the first move up. It moved over $4 in about 90 seconds. If I had been prepared, I probably could have made a couple thousand dollars off it with hotkeys. I made a nice scalp on it, but premarket things move FAST. No way could you trade that fast and that early with Fidelity.

SD51555

5 year old buck +

We're on the front end of earnings season. Lots of good stuff in play all of a sudden. Having seen two days of calm in a row, I'm going back in.

Sold SNAP Feb 6th $7 puts for 15 cents/ea.

Sold UNP Jan 30th $220 puts for $1.80/ea.

Sold LMT Jan 30th $635 call for $2.32.

Sold CVX Jan 30th $180 calls for 36 cents/ea.

Sold DOW Jan 30th $25 puts for 32 cents/ea.

I'm guarded on DOW. That's been a dog for years. I'm only flirting with a few shares. Dividend is rich, price is down, and options juice is good headed into earnings. I'll cast a worm out there.

I normally don't sell calls into an earnings announcement, but I've got a feeling about this quarter. It's also a good time to acquire stuff with puts, and it's my favorite, and often only way I will buy a stock, unless I'm just investing weekly trading generated cash. As the cash comes in, I've been stashing it in either ET, WEC, or PRU.

I recently emptied those bucks when Visa and UNP came around. It takes a lot of free cash to sell puts on that stuff. I lost all of my EPD at a handsome little gain, so I'm gonna be touring the dividend aristocrats until EPD comes back down.

Sold SNAP Feb 6th $7 puts for 15 cents/ea.

Sold UNP Jan 30th $220 puts for $1.80/ea.

Sold LMT Jan 30th $635 call for $2.32.

Sold CVX Jan 30th $180 calls for 36 cents/ea.

Sold DOW Jan 30th $25 puts for 32 cents/ea.

I'm guarded on DOW. That's been a dog for years. I'm only flirting with a few shares. Dividend is rich, price is down, and options juice is good headed into earnings. I'll cast a worm out there.

I normally don't sell calls into an earnings announcement, but I've got a feeling about this quarter. It's also a good time to acquire stuff with puts, and it's my favorite, and often only way I will buy a stock, unless I'm just investing weekly trading generated cash. As the cash comes in, I've been stashing it in either ET, WEC, or PRU.

I recently emptied those bucks when Visa and UNP came around. It takes a lot of free cash to sell puts on that stuff. I lost all of my EPD at a handsome little gain, so I'm gonna be touring the dividend aristocrats until EPD comes back down.

Telemark

5 year old buck +

You guys are way ahead of me, but I am curious of what you think of the covered call ETF's, like SPYI , QQQI

It's a dividend ETF rather than a growth ETF. They can have a better return in bull markets due to the call option strategy, but the main thing is that it generates cash rather than growth. When I get a bit older, it is probably something I would be interested in so that I could earn income without selling any of my position. The dividends should be taxed as qualified dividends, I believe. That means a max tax rate of 20% as opposed to ordinary income tax rates, though the rate could be as low as 0% depending on your income level and source.

These ETFs can be held in an individual brokerage account or a Roth IRA, rather than a tax-deferred account in order to take advantage of the income in case you have maxed out your tax-deferred retirement account. This can have significant tax implications, especially when taking required minimum dispersal from a tax-deferred account at age 73. It can also provide you tax-free income in a Roth IRA after age 55.

This is not the whole picture, and some details may be incorrect, as I have not considered purchasing this asset class yet.

SD51555

5 year old buck +

It's usually a tradeoff between growth and income. Trouble is, any ETF that is geared towards income always seems to severely underperform their stated objective. High dividend yielding stock ETFs can't eek out 2.5%, when they could fill them with solid stocks that yield 3-5%. These buy-write strategy funds are the same way.You guys are way ahead of me, but I am curious of what you think of the covered call ETF's, like SPYI , QQQI

It is very easy to make 12% annual income selling calls on dividend stocks. The hard part is avoiding getting "bucked off" when your stocks surge and you're left behind and avoiding a falling piano in high yielding stocks.

I don't like funds because they can fill them with garbage, and that's what the S&P 500 is. I woudn't own 90% of the stocks in it, ever. Of the 50 that leaves, 40+ of them are overpriced most of the time, and the ones that aren't, aren't always good options trading stocks.

I try to encourage people to try to learn selling covered calls and cash secured puts. It can cut years off your working time on earth, and the job pays thousands of dollars per hour for what you have to put into it. What I mean is, it takes about 5 minutes per week to manage. Put $800 in a trading account, get approved for level 1 options trading, and then start farting around with SNAP. It's cheap, and attractively priced right now. It'd give you the chance to go through the motions and experience of making options trades.

Once you're comfortable with it, you can work on higher priced stocks which is where the safety and better returns are found. Single digit stocks are bottle rockets, and can fizzle out as fast. But big, boring, and old is where the money is at.

bigboreblr

5 year old buck +

Hitting the Roth and 457k hard at work. Feel like playing around a bit. Got a T Rowe price mutual that has been doing 15% on average the past 5 .

Was hoping to get stock advice and Van Halen tickets from this guy.

Feel clueless with this stuff. I try to buy things that make sense. These folks actual make this, and they doing to do good because of that. Or, these guys are good fellas doing good work, just got some bad luck lately.....

Any platform I should be using. Doing robinhood's free basic stuff.

I got T Rowe Price and since I work in government 457k, they have a higher Roth limit. They got a more aggressive mutual in there that has been doing 15% the past 5 years overall. Feel like my dumb luck ain't gonna be at that.

Looking for things that will make a 3 month turnaround, then put the winnings in something solid. AI's the cats meow right now. Feel like the physical support of AI isn't so bad. electrical and IT equipment suppliers, construction folks, owners of data centers.

Got not clue on bottle rockets...... Worried Im gonna shoot my eye out.

This summer, I will have $2000 a month less bills. Gig is to get 60 grand to put on beach side condo in 2 years. Could do it now, but wife is hemming n hawing where to do this. My plan A almost went into the ocean. My new plan A place we are renting next month to check out the place.

Was hoping to get stock advice and Van Halen tickets from this guy.

Feel clueless with this stuff. I try to buy things that make sense. These folks actual make this, and they doing to do good because of that. Or, these guys are good fellas doing good work, just got some bad luck lately.....

Any platform I should be using. Doing robinhood's free basic stuff.

I got T Rowe Price and since I work in government 457k, they have a higher Roth limit. They got a more aggressive mutual in there that has been doing 15% the past 5 years overall. Feel like my dumb luck ain't gonna be at that.

Looking for things that will make a 3 month turnaround, then put the winnings in something solid. AI's the cats meow right now. Feel like the physical support of AI isn't so bad. electrical and IT equipment suppliers, construction folks, owners of data centers.

Got not clue on bottle rockets...... Worried Im gonna shoot my eye out.

This summer, I will have $2000 a month less bills. Gig is to get 60 grand to put on beach side condo in 2 years. Could do it now, but wife is hemming n hawing where to do this. My plan A almost went into the ocean. My new plan A place we are renting next month to check out the place.

bigboreblr

5 year old buck +

Im clueless whether to hit all roth or do pretax 457. So I do 1/2 n 1/2.

What I like about toying with the stock market the most is, when you out there spendng cash on stuff.; you re more mindful of stupid stuff your buying or deciding not to buy. Hey, I could put my money here n make some profit, or spend it here and get -100% on it.

Selling stuff of facebook marketplace or craigslist make you rethink bout buying stuff you dont need. Although dumb me want a 21ft walk around right now.... in janurary. Buy low...

What do you guys think you should buy n keep?

For a month? Netflicks?

For 3 months? Nivida?

For a year? Amazon?

For 5 years? Lilly?

They say 20% each of each major subject. Feel clueless what to spend on entertainment stocks?

What I like about toying with the stock market the most is, when you out there spendng cash on stuff.; you re more mindful of stupid stuff your buying or deciding not to buy. Hey, I could put my money here n make some profit, or spend it here and get -100% on it.

Selling stuff of facebook marketplace or craigslist make you rethink bout buying stuff you dont need. Although dumb me want a 21ft walk around right now.... in janurary. Buy low...

What do you guys think you should buy n keep?

For a month? Netflicks?

For 3 months? Nivida?

For a year? Amazon?

For 5 years? Lilly?

They say 20% each of each major subject. Feel clueless what to spend on entertainment stocks?

SD51555

5 year old buck +

If you don't own energy, it's the last great deal still available. I'd be buying CVX now. Oil cannot stay this low. Producers can't make money, the middle east cannot feed itself. I'm stunned it's so cheap because nobody behind the screen wants affordable energy.Im clueless whether to hit all roth or do pretax 457. So I do 1/2 n 1/2.

What I like about toying with the stock market the most is, when you out there spendng cash on stuff.; you re more mindful of stupid stuff your buying or deciding not to buy. Hey, I could put my money here n make some profit, or spend it here and get -100% on it.

Selling stuff of facebook marketplace or craigslist make you rethink bout buying stuff you dont need. Although dumb me want a 21ft walk around right now.... in janurary. Buy low...

What do you guys think you should buy n keep?

For a month? Netflicks?

For 3 months? Nivida?

For a year? Amazon?

For 5 years? Lilly?

They say 20% each of each major subject. Feel clueless what to spend on entertainment stocks?

I also like WEC, PRU, and NGVC. None of those are going to be high flyers, but I wouldn't not be afraid to hold them if the ass falls out of the market.

Utilities could be a sleeper about to go higher in the next few years. One could chase the bond rally too. I wouldn't do it, but if you believe the president can get rates down (and he must quickly or we'll refinance the war and daycare debt at credit card rates), long term bond values could shoot up a ton.

Now you have me thinking of buying long term bonds. What a trade coming. Refinance $9 trillion in debt this year, sell it to all your buddies at the big banks, and then drive rates down giving these guys a 100% gain on treasuries? Ok, I'm in at 8:30 tomorrow morning. Look at this chart in TLT before rates started rising. We go back where it was 4 years ago, it'll be the heist of the century, bigger than covid, bigger than a century of war.

Telemark

5 year old buck +

If you don't own energy, it's the last great deal still available. I'd be buying CVX now. Oil cannot stay this low. Producers can't make money, the middle east cannot feed itself. I'm stunned it's so cheap because nobody behind the screen wants affordable energy.

I also like WEC, PRU, and NGVC. None of those are going to be high flyers, but I wouldn't not be afraid to hold them if the ass falls out of the market.

Utilities could be a sleeper about to go higher in the next few years. One could chase the bond rally too. I wouldn't do it, but if you believe the president can get rates down (and he must quickly or we'll refinance the war and daycare debt at credit card rates), long term bond values could shoot up a ton.

Now you have me thinking of buying long term bonds. What a trade coming. Refinance $9 trillion in debt this year, sell it to all your buddies at the big banks, and then drive rates down giving these guys a 100% gain on treasuries? Ok, I'm in at 8:30 tomorrow morning. Look at this chart in TLT before rates started rising. We go back where it was 4 years ago, it'll be the heist of the century, bigger than covid, bigger than a century of war.

View attachment 87964

Why has TLT been selling off on high volume for 2 years?

bigboreblr

5 year old buck +

Wondering if the oil folks keep it low long enough to squash the renewable energy bug good. Chaos is cash.

Someone out there is playing checkers with this world.

Just wish high test wasn't a dollar more than 87.... I miss sonoco 94 for 10 cents more. I had a car that needed a 1/2 fuel line, because a 3/8's was starving it. I'm sure Billy Bob Thornton would tip his hat to that.

Doubling in 5 years would be more than happy for me.

You guys just gambling, or leave some in slow and steady stocks? After leaving the supermarket, I think Kraft foods has a good racket going. Got coca-cola too.

Threw a few bucks at better homes n finance with the interest rate shoots n ladders game.

Someone out there is playing checkers with this world.

Just wish high test wasn't a dollar more than 87.... I miss sonoco 94 for 10 cents more. I had a car that needed a 1/2 fuel line, because a 3/8's was starving it. I'm sure Billy Bob Thornton would tip his hat to that.

Doubling in 5 years would be more than happy for me.

You guys just gambling, or leave some in slow and steady stocks? After leaving the supermarket, I think Kraft foods has a good racket going. Got coca-cola too.

Threw a few bucks at better homes n finance with the interest rate shoots n ladders game.

bigboreblr

5 year old buck +

Got to look at what options thing is. While I learn more, just buying the whole pig, fat n all.

Telemark

5 year old buck +

Wondering if the oil folks keep it low long enough to squash the renewable energy bug good.

Renewable won't go away. They just have to figure out how to execute it properly. First step is stop the subsidies for wind and put it into battery technology. I'm looking more and more at modular nuclear as the next big thing in energy.

I think we've reached peak oil globally. The world is going to get a lot more interesting before it calms down again. AI is the current thing, and it will only hit a trough if hardware manufacturers run into difficulties, but it will come back, because we need it. Hopefully Intel's gamble pays off.

The timelines are just very hard to predict.

bigboreblr

5 year old buck +

Was just typing what you thought of lithium, nuclear, and AI.

Think too late to play with Bitcoin. Was interested in Solana.

I bought plug power when they first got a marketable product. Fuel cells for fork lifts. Just sold that off last week or so. I think with my ablemarble stock, I got free shares of lithium Americas and argentina. Argentina one is looking promising. Not sure if we can make enough lithium to satisfy the battery need.

They say the next war will be about water. Im sitting on ecolab for awhile. I live in the general capital district area of NY. GE used to be a huge powerhouse. My dad even worked there for awhile. I know too much about GE to trust em. Thinking mining minerals out of desalination run off might be a thing.

Think too late to play with Bitcoin. Was interested in Solana.

I bought plug power when they first got a marketable product. Fuel cells for fork lifts. Just sold that off last week or so. I think with my ablemarble stock, I got free shares of lithium Americas and argentina. Argentina one is looking promising. Not sure if we can make enough lithium to satisfy the battery need.

They say the next war will be about water. Im sitting on ecolab for awhile. I live in the general capital district area of NY. GE used to be a huge powerhouse. My dad even worked there for awhile. I know too much about GE to trust em. Thinking mining minerals out of desalination run off might be a thing.

Telemark

5 year old buck +

Was just typing what you thought of lithium, nuclear, and AI.

Think too late to play with Bitcoin. Was interested in Solana.

I bought plug power when they first got a marketable product. Fuel cells for fork lifts. Just sold that off last week or so. I think with my ablemarble stock, I got free shares of lithium Americas and argentina. Argentina one is looking promising. Not sure if we can make enough lithium to satisfy the battery need.

They say the next war will be about water. Im sitting on ecolab for awhile. I live in the general capital district area of NY. GE used to be a huge powerhouse. My dad even worked there for awhile. I know too much about GE to trust em. Thinking mining minerals out of desalination run off might be a thing.

Lithium scares the absolute crap out of me.

How long before some terrorist figures out he can take down a plane with his electronics? Go into the lavatory, pile up a bunch of paper and whatever flammable crap he brought with him, throw a power bank and a laptop on the pile, then smash his iPhone and get the whole thing burning. Imagine the YouTube videos of a fireball falling out of the sky with 500 souls on board.

And let's not forget what happened in the Palisades when 1000 lithium batteries exploded and contaminated the air and ground. Anyone rebuilding there yet?

jsasker007

5 year old buck +

Nuclear and Hydrogen but they will be a few years out yet. Electricity and realty right now. jmho

Similar threads

- Replies

- 18

- Views

- 569

- Replies

- 13

- Views

- 897