BuckSutherland

5 year old buck +

Just curious; How many of you guys are snagging more metals?

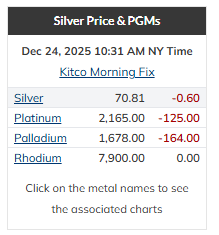

I had a bunch of 1oz silver pieces going back 15+ years that I probably bought around $15. Had 1 oz of gold bought around $800. Bought ten 10 oz bars of silver from Costco back in mid Sept when it was around $42/oz. Also bought 1 more piece of gold that day for around $3,600.

I bought 100 shares of palladium etf (PALL) on 10/15 at $141/share and watched it immediately dip. It has come back now and sitting at around $170 today.

I was in Costco on Friday and the same silver I paid $429 for 3 months ago was $679. I imagine its $710-720 today. Its really hard to source the physical. Had I known Costco would have some last Friday I would have bought an additional 40oz. Didn't bring any of the worthless greenbacks with me to buy it.

The dollar gets more worthless by the day. Trump sure as hell isn't doing anything to save it. His masters are saying keep printing and he's following their script like a good little solider.