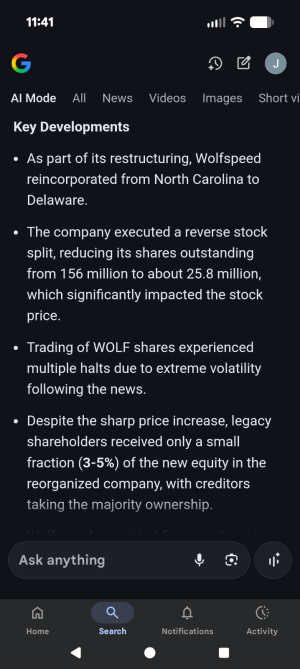

That is what it looks like to me also.Looks like they got out of debt by screwing over their investors.

-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

jsasker007

5 year old buck +

Makes no sense to me how the highest price I ever paid was just over $3 and most was bought for almost half of that and now it tells me that my average share price is over $313 a share.

Native Hunter

5 year old buck +

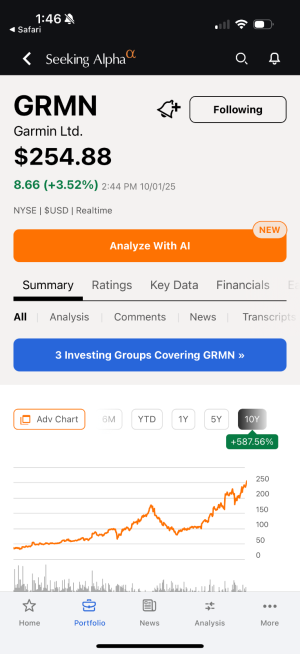

I'm not one to jump in and out, but I must admit I'm getting a bit nervous. My CS account was up 130% over 2 years as of today, and I did a bunch of selling and went to 25% cash. I also have a 15% trailing stop on a bunch of stuff that has done well. I hope the run continues, but now I have a little cash to shop for bargains if it doesn't.

PatinPA

5 year old buck +

That would make sense for what I'm seeing. By that ratio my 282 shares would be reduced to 47 but only 4% of that is around 2. Which is what Fidelity says I have. At a 90% loss so the creditors can get rich. Yay!

jsasker007

5 year old buck +

Probably see some type of class action suit for this one. Might have to join in if that's the case. We'll see

Angus 1895

5 year old buck +

AgreedJust curious…do you a) believe that the economy will just collapse and b) if it does you think bartering a couple silver pieces around is gonna save your existence!

If the economy collapse and therefore society I think owning some silver is the least of my concerns

I invested in marlins instead!

Attachments

jsasker007

5 year old buck +

With guns and ammo you can "acquire" everything else. jmo

hunts_with_stick

5 year old buck +

I did buy something Amazon today, but that’s it. Looks like it has taken a small dip

jsasker007

5 year old buck +

I've been riding ASTS, SATS and TLRY lately. TLRY is the one that's really gonna pop off once they start getting a little more traction in my opinion. ASTS & SATS are competing with each other but sounds like there's plenty of room for both so for now I'm holding both but way heavier on ASTS.

Bowsnbucks

5 year old buck +

We don't need any stinkin' financial regulatory agencies with teeth to prevent these things from happening. We should just trust those businesses and their gazillionaire CEO's to do right by us - - - and not load their own pockets with some sort of pump & dump moves ............Looks like they got out of debt by screwing over their investors.

Some financial regulatory agencies have recently been gutted, de-funded, or completely eliminated. CFPB is one that made the news. Trust 'em, boys ....... trust 'em.

jsasker007

5 year old buck +

Gives the lawyers plenty to do. Trust half of what you see and nothing that you hear. Now with the AI you can't even trust half of what you see.We don't need any stinkin' financial regulatory agencies with teeth to prevent these things from happening. We should just trust those businesses and their gazillionaire CEO's to do right by us - - - and not load their own pockets with some sort of pump & dump moves ............

Some financial regulatory agencies have recently been gutted, de-funded, or completely eliminated. CFPB is one that made the news. Trust 'em, boys ....... trust 'em.

SD51555

5 year old buck +

STZ is getting some legs. My first lot cost me $161/share. Second equal sized lot cost $132 on Friday, So I’m in at $146 average.

They report on 10/6. I’m hoping all the weak knees have been driven out and there is a pop coming in less bad news. I’m not selling any calls into the earnings report. If they pop, I don’t wanna get left losing it $15 below the market price.

Sent from my iPhone using Tapatalk

They report on 10/6. I’m hoping all the weak knees have been driven out and there is a pop coming in less bad news. I’m not selling any calls into the earnings report. If they pop, I don’t wanna get left losing it $15 below the market price.

Sent from my iPhone using Tapatalk

SD51555

5 year old buck +

Buffett's Berkshire Near $10 Billion Deal For Occidental's Chemical Unit | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

hunts_with_stick

5 year old buck +

Keep an eye on cat. If it takes a downswing today and tomorrow might be a great opportunity to jump in

Similar threads

- Replies

- 18

- Views

- 556

- Replies

- 13

- Views

- 894