SD51555

5 year old buck +

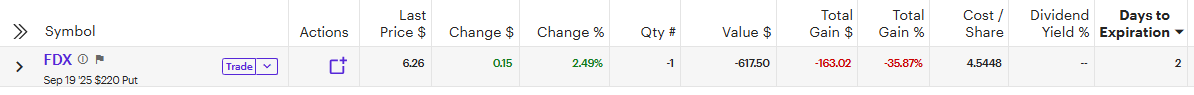

FedEx reported today. Looks like they made it.

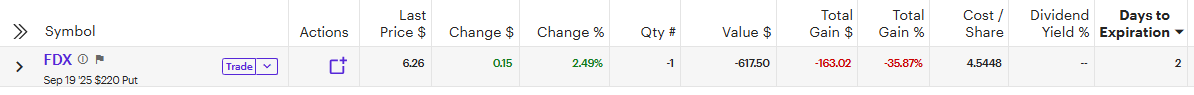

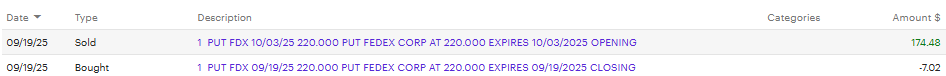

I had a line in the water to scoop up more shares at $220 if they dove on the news. They still could. Wouldn't be the first time to have a big after hours and then get crushed at market open. Now that they reported, this will go to almost zero tomorrow morning if the spike holds, and 99% of that $454 I got paid on Friday will fall to the bottom line. 2% in a week is nothing to sneeze at.

I had a line in the water to scoop up more shares at $220 if they dove on the news. They still could. Wouldn't be the first time to have a big after hours and then get crushed at market open. Now that they reported, this will go to almost zero tomorrow morning if the spike holds, and 99% of that $454 I got paid on Friday will fall to the bottom line. 2% in a week is nothing to sneeze at.