Bowsnbucks

5 year old buck +

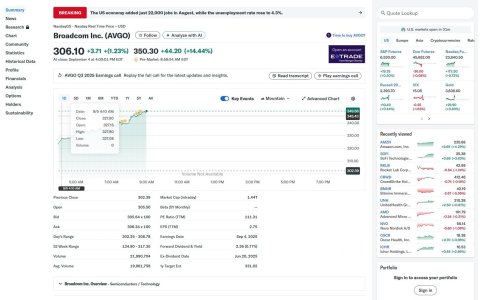

I put more stock into folks who've been around for decades, and seen many market cycles /spikes /corrections /wars /crashes - not the latest trends. I've also bought shares when markets are down, and done well by buying "on sale" ...... but those were in more "normal" times. Recently, even pro money managers don't know where to tell their clients to put money. A politically independent Fed is critical to market stability. Monetary policy driven by any president's political agenda is a recipe for market chaos & loss of stability / trust for all investors. Why do you think foreign investments have been outperforming the U.S. market indexes lately? The U.S. markets have been a trading range for the most part - up, then down - up, then down. Are there some individual winners? There are, but one better be able to hit the right stock(s), at the right time ...... and even the best pro money managers are hard-pressed to do that on a consistent basis. History proves that out.That doesn’t mean they are correct ! I’m fully invested in. My stocks, gold/silver & real estate have all doubled or tripled since 2016.

Lots of those so called experts were telling investors to bail out or be cautious . I’m not worried—I was buying the dips (COVID, 2022, & the recent media inspired tariff scare) … in all cases the stocks were on sale & buying good companies on sale has proven to be a great strategy!

The Covid period of dropping share prices was a good time to buy in. No argument there. Long-term charts from just about any mutual fund company prove the drop in the markets were caused by the Covid global pandemic - and it was a global market response to Covid - not any one country's moves. Look at any charts for the last 5 and 10 years. The start of 2020 was the beginning of the markets' sinking, and it lasted for about 3 years before global markets began to rebound. Any chart, from any money management company, in any market sector shows the same thing. April 8th of 2025 was the day the tariffs were announced, and the markets - globally - all dropped. Why? Investors anywhere don't like instability, chaos, turmoil, and the effects that tariffs put on the global economy. All investors & money managers around the world aren't stupid. The 2 previous tariff "wars" in U.S. history both proved to be economic disasters. Today, even the CEO's of many companies have publicly voiced their opposition to the tariffs. From one day to the next, they don't know how to plan or deploy capital in their business plans. Are those guys all stupid??? What are the real lessons of our tariff history??? There are no quick, easy, miraculous fixes to very complex problems. - - - - - - Just some thoughts .....