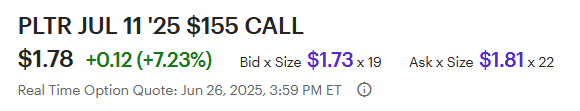

What do you guys do with your high flying stocks? I bought 400 shares of Palantir around $20. I sold 200 at $82 and now I have 200 left. Sitting just under 600% gain with the last 200 shares. Also have 450 shares of Rocket Lab around 200% gain. I bought some HIMS the other day when it crashed 30%. Thinking about locking in some of these big gains.....

AMD is showing signs of life

MSFT has been very profitable

COST is stress free to own

Lucid sucks

Rumble sucks

Sofi- wish it would get its ass in gear

My stuff has been really hot since early April. I had about 70k I wanted to get invested on the tariff downswing and never did any of it. Was hoping for another leg down. Look like a real dumbass now. I was so damn close to pulling the trigger right around April 7th and never did any of it. Missed a great opportunity when stuff was really hammered down.