Foggy47

5 year old buck +

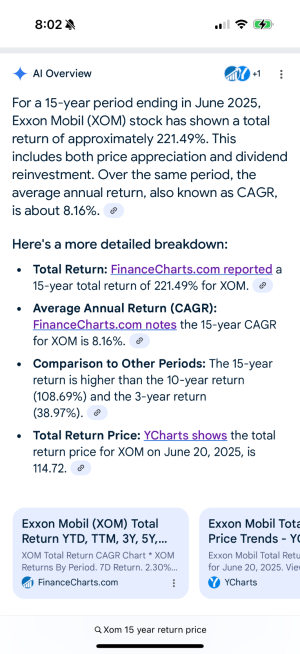

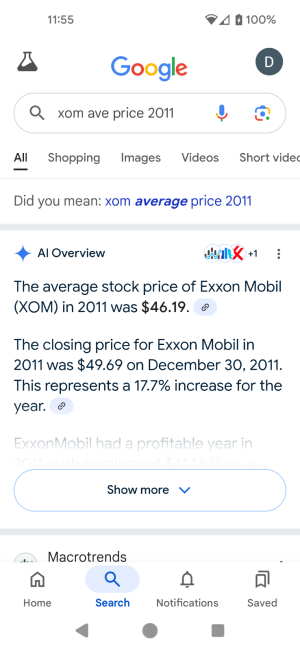

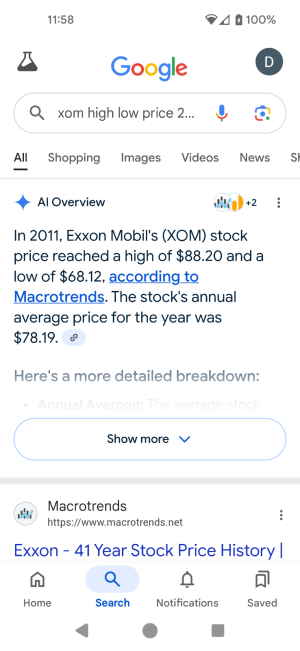

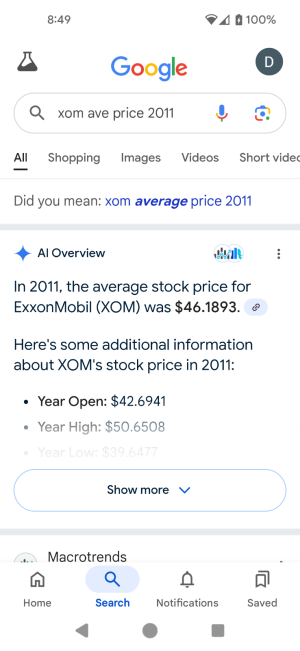

I've been retired now for over 20 years. We have a broad mix of stocks and likely emulate the S&P500 in ROI. We draw 4% annually to live and provide for some other things. I can assure you we have improved our net worth over that time and the market has provided just as planned for. We continue to own a broad basket of stocks.....and stay invested through thick and thin........and we did go thru the melt-down of the 2018 markets (Phew). At this time....the stocks we own are showing capitol gains at 94% (vs those that have lost) through these times. Some are up very bigly. All are a mix of "household names". Hard to argue with those facts. (and I do not report this info to brag....rather to inform you that this system is quite viable....use it!)If you had bought XOM almost 15 yrs ago you would not even doubled your money, only a 50% uptick before dividends. Ask me how I know

Lotta luck and timing in this market thing. Note the S&P 500 returned about 4.5x over that long period.

Best to be boring and stick to a broad index fund

I hope I live long enough to go through another melt down or two. MAGA!

Last edited: