Howboutthemdawgs

5 year old buck +

At the same time the socialists stop flying private to fight the oligarchsWill the Vatican have open borders? Open borders for thee and not for me.

At the same time the socialists stop flying private to fight the oligarchsWill the Vatican have open borders? Open borders for thee and not for me.

Not if you only do the playing around parts in a Roth, limits contributions obviously but it does avoid that & it scratches the itch.Selling stocks when you don't hold them for more than a year will cost you twice as much in taxes on any profit you make from selling.

We have combinations of active and index funds. Had 'em for decades. We have a mix of growth, value, dividend-payers, large & small cap stuff, MM fund, real estate, & bond funds. Depending on strong trends, we may tilt money in a certain direction to take advantage of those situations. Diversification tends to smooth out bumps over the span of time. A person aged 25 to 30 would probably be more aggressive than a person aged 65 to 70. Younger people have more years to recoup any losses. As people age, they tend to look to have investments that generate streams of passive income to replace job income. If planned wisely, one can live off the income "gravy", plus Social Security & Medicare (which we paid into) - and not dig too much into their principal. IMO, that ought to be the goal of us non-billionaires.What do you guys think I have seen this back and forth.

Index funds like what @Bowsnbucks mentions, say VYM, or high dividends like ZIM & INSW, single stocks like Tesla or Nvidia, combos of all?

I love these discussions of 'over time' whats the right approach.

Bogle famously said, "Why try to find the needle in the haystack. Just buy the whole stack." Over decades since the Great Depression, many mathematically-savvy folks have shown that beating the "market" on a consistent basis is nearly impossible. That's not to say certain stocks or funds can't beat the market in a given year - or 2 - they can and do. But over the long-term, indexes, which mimic the entire market (or specific segments of it), have beaten individual stocks and funds ...... and at much lower cost to investors. Most folks are not Buffet, making big bets on a few companies like he does, so we take the route most likely to get us to financial security. With mutual funds, we get professional management / stock picking, in a much more efficient way to buy stocks & other investments than doing so ourselves, at cheaper expense ratios. And you don't have to spend loads of hours researching individual stocks ..... if you know how to do such research yourself. I don't want to spend my life in front of a computer screen - the fund managers are paid well to do the research.I'm pretty sure it was Charlie Munger that said you can't beat the market. I went and checked to see if the actively managed funds could beat the S&P 500. Keep in mind that these funds have trained trading professionals with incomprehensible resources. Here is how they did since 2001:

View attachment 77211

Taken from here: https://www.spglobal.com/spdji/en/documents/spiva/spiva-us-year-end-2024.pdf

About 35% of the large-cap funds beat the S&P in 2024, which is honestly better than I would have thought.

As you extend the timeline, the odds get worse and Charlie gets more correct:

View attachment 77213

I still keep some solo stocks, but mostly because I believe in the company or I know more about what they do than I think the general public. Maybe I am leaving money on the table by not being more active? To me it seems like the more I learn about equity investing, the less it makes sense. For now, I mostly just dollar cost average into index funds. Also, Bitcoin, but that is a whole other thing.

I'd sure like to see the offset to the income tax from all the tariff revenue. It'd be a shame to force all those costs on us and the government just pisses all the money away bombing peasants in the middle east.I hope we keep the 30-40% tariffs on China . I’m not an expert on this, but won’t we get used to paying extra for Chinese made products and also generate revenue?

I studied my weekly buys and determined I could probably get by without any Chinese purchases ?… however I live in Rural MN . Maybe the metro people are not as fortunate to avoid that cost ?

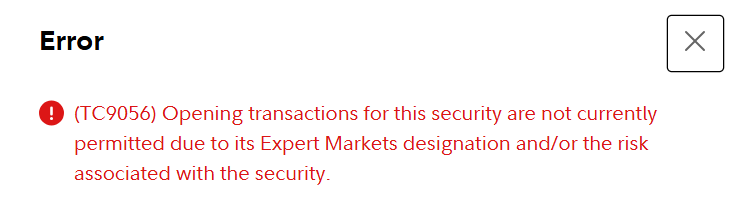

I believe you don't have the right type of account to purchase that one. They are trying to get you to call them and go through a broker I think. jmoDoes anyone know what this means?

View attachment 77349

I've been watching TBIO for a while now. Their stock has been dropping. Down to 0.01 now. They announced on their website that they just received a pretty substantial contract. But when I try to buy it, I get this error message. I already own a little and I'd really like to buy a bunch more, especially at this price.

I was thinking if we had a clause that revenue would be required for debt reduction? But I doubt they would do that ?I'd sure like to see the offset to the income tax from all the tariff revenue. It'd be a shame to force all those costs on us and the government just pisses all the money away bombing peasants in the middle east.

They cannot reduce the debt. We're so far insolvent our only hope is to slow down the rate of accumulation. We've still got that pesky $9 trillion we have to rewrite this year at 3x the previous interest expense.I was thinking if we had a clause that revenue would be required for debt reduction? But I doubt they would do that ?

There really are not good alternatives.....IMO.I’m just glad I didn’t panic and sell everything when the sky was falling. We’ve seen market downturns enough times to hold on for the ride. Every time it happens people say, “this time it’s different”. Every time so far, it comes back. I’ll just ride it and hope history is a good teacher.

Sent from my iPhone using Tapatalk

There really are not good alternatives.....IMO.