-

If you are posting pictures, and they aren't posting in the correct orientation, please flush your browser cache and try again.

Edge

Safari/iOS

Chrome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is the bottom in?

- Thread starter Peplin Creek

- Start date

jsasker007

5 year old buck +

I'm not too far off from having my personal best single day in the markets. Probably just jinxed myself.

Yeah, but your personal best day in the market would be minimal losses still right?I'm not too far off from having my personal best single day in the markets. Probably just jinxed myself.

jsasker007

5 year old buck +

Nicely done sir, nicely done.Yeah, but your personal best day in the market would be minimal losses still right?

jsasker007

5 year old buck +

Somehow I didn't hear anything about it.…..,& we just got the first American Pope ever !

Howboutthemdawgs

5 year old buck +

Open border liberal. Shocking…..,& we just got the first American Pope ever !

Bowsnbucks

5 year old buck +

You have more basketballs than I do with making moves, jsasker!!! Best of luck with what you buy & sell. I only watch the markets every day to see what's happening, in the event of a slide - for buying opportunities for more fund shares. We "stay the course" for the most part, and don't panic when markets slide. We get to ride the climb back up that way.I have some stocks that I try not to touch and let them go long term but then there's roughly half of my stuff I'm always looking to take a little profit and buy something "on sale". Sometimes the juggling works and sometimes it doesn't. I just don't have the patience/discipline to just sock 100% away and leave it alone. I have an account for my grandkids,wife,and one for my daughter that I manage right now but I only "gamble" with my own account.

We've had some actively-managed funds (still do), and some index funds that we've contributed to over & above what our employer-matched retirement funds were fed with. We dollar-cost-averaged into them, and re-invested all the divs., interest, and capital gains back into them. I had followed the track records of several mutual funds for about 5 years before I invested any $ in them. This started when I was a senior in HS (mid-1970's). Those track records were impressive over a then-normal, "regular" bank savings account interest of 5.25% - the funds were returning 12% to over 20% a year. I asked myself, "What am I doing saving money in a bank?" I joined a credit union for better interest back then (7%), and far fewer fees than banks, for my cash stash. I began investing regular, set amounts of money into a couple mutual funds back then. I picked 1 penny-stock for $250, and that stock vaporized. I didn't have the stones - or the time - to study up on individual stocks & make wise choices, so several other mutual funds became our vehicles for investing. The only tinkering I've done is when the markets slide / tank, at which time I add more cash to the funds ... "buying on sale", as you said. I've been a fan of Ben Graham, Bogle, Buffet, Munger, Peter Lynch, and Michael Price for years. "The miracle of compounding interest."

jsasker007

5 year old buck +

The only really, really crappy outcome I had was with Bed Bath and Beyond. If that one didn't teach me a lesson I might be beyond help. Mistakes have been made for sure but learning from them and looking into what makes companies have any value is helpful. Big learning curve with bumps along the way.

Howboutthemdawgs

5 year old buck +

Too late. https://nypost.com/2025/05/08/us-ne...years-retweeting-criticism-of-trump-policies/I just hope the new Pope stays out of politics. It never helps to upset one side or the other when you have a billion+ members !

Brian662

5 year old buck +

Death, taxes, and the Catholic Church pandering..Open border liberal. Shocking

buckvelvet

5 year old buck +

What do you guys think I have seen this back and forth.

Index funds like what @Bowsnbucks mentions, say VYM, or high dividends like ZIM & INSW, single stocks like Tesla or Nvidia, combos of all?

I love these discussions of 'over time' whats the right approach.

Index funds like what @Bowsnbucks mentions, say VYM, or high dividends like ZIM & INSW, single stocks like Tesla or Nvidia, combos of all?

I love these discussions of 'over time' whats the right approach.

jsasker007

5 year old buck +

Index funds are usually the base that is suggested when starting because they have been proven over the years. What ever stocks you buy the biggest issue is entry price. Buying something that someone else has had success with won't guarantee you that some success because they got in at a different time. Companies that have been around for years/decades that have been through the good and bad cycles and are still around and profitable are usually safe bets. Nothing guaranteed in the markets. jmho

bwoods11

5 year old buck +

It’s possible to do both .What do you guys think I have seen this back and forth.

Index funds like what @Bowsnbucks mentions, say VYM, or high dividends like ZIM & INSW, single stocks like Tesla or Nvidia, combos of all?

I love these discussions of 'over time' whats the right approach.

I pick my own stocks , but my wife’s IRA is with Fidelity. So far I’m ahead (exact same contributions) … but a key to that is heavy Apple & Valero both have done extremely well.

You could have a side account ? Multiple accounts ? So many options …

I like a combo of dividend stocks (maybe 75% and 25% growth and high flyers)?

Last edited:

Howboutthemdawgs

5 year old buck +

My uneducated .02. Index funds are going to limit your risk but also limit your gains. Your take the good with the bad. Single stocks can have big swings. Both have their uses. I like single stocks in my trading account and index in retirement

jsasker007

5 year old buck +

Also being diversified is a good plan. Just need to win more than you lose but like everything there's a learning curve.

jsasker007

5 year old buck +

Selling stocks when you don't hold them for more than a year will cost you twice as much in taxes on any profit you make from selling.

Mortenson

5 year old buck +

Will the Vatican have open borders? Open borders for thee and not for me.Open border liberal. Shocking

Hoytvectrix

5 year old buck +

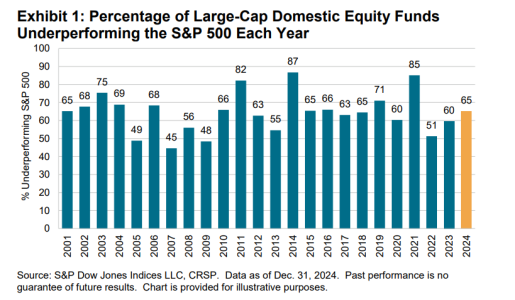

I'm pretty sure it was Charlie Munger that said you can't beat the market. I went and checked to see if the actively managed funds could beat the S&P 500. Keep in mind that these funds have trained trading professionals with incomprehensible resources. Here is how they did since 2001:

Taken from here: https://www.spglobal.com/spdji/en/documents/spiva/spiva-us-year-end-2024.pdf

About 35% of the large-cap funds beat the S&P in 2024, which is honestly better than I would have thought.

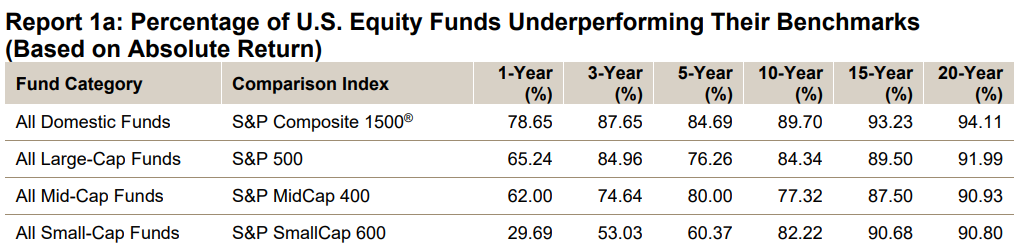

As you extend the timeline, the odds get worse and Charlie gets more correct:

I still keep some solo stocks, but mostly because I believe in the company or I know more about what they do than I think the general public. Maybe I am leaving money on the table by not being more active? To me it seems like the more I learn about equity investing, the less it makes sense. For now, I mostly just dollar cost average into index funds. Also, Bitcoin, but that is a whole other thing.

Taken from here: https://www.spglobal.com/spdji/en/documents/spiva/spiva-us-year-end-2024.pdf

About 35% of the large-cap funds beat the S&P in 2024, which is honestly better than I would have thought.

As you extend the timeline, the odds get worse and Charlie gets more correct:

I still keep some solo stocks, but mostly because I believe in the company or I know more about what they do than I think the general public. Maybe I am leaving money on the table by not being more active? To me it seems like the more I learn about equity investing, the less it makes sense. For now, I mostly just dollar cost average into index funds. Also, Bitcoin, but that is a whole other thing.

Similar threads

- Replies

- 18

- Views

- 559

- Replies

- 13

- Views

- 896