Native Hunter

5 year old buck +

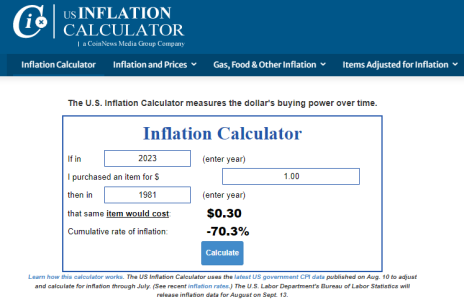

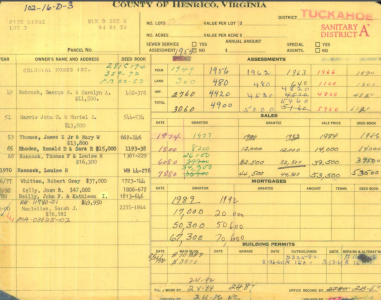

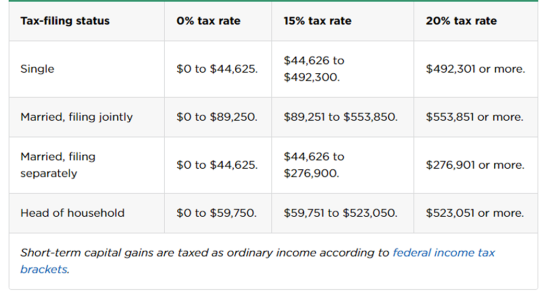

A relative of mine just sold a farm that he inherited in 1981. He will have to pay capital gains tax this year on the difference between what he sold the land for and what it was worth at the time he inherited it. What would be the best way to go about this and come up with the value of the land in 1981? Obviously, he would want this number to be as high as possible but something that he could defend if questioned by the IRS.